WTI Crude Futures - Remain Short

rhboskres

Publish date: Wed, 15 Aug 2018, 05:36 PM

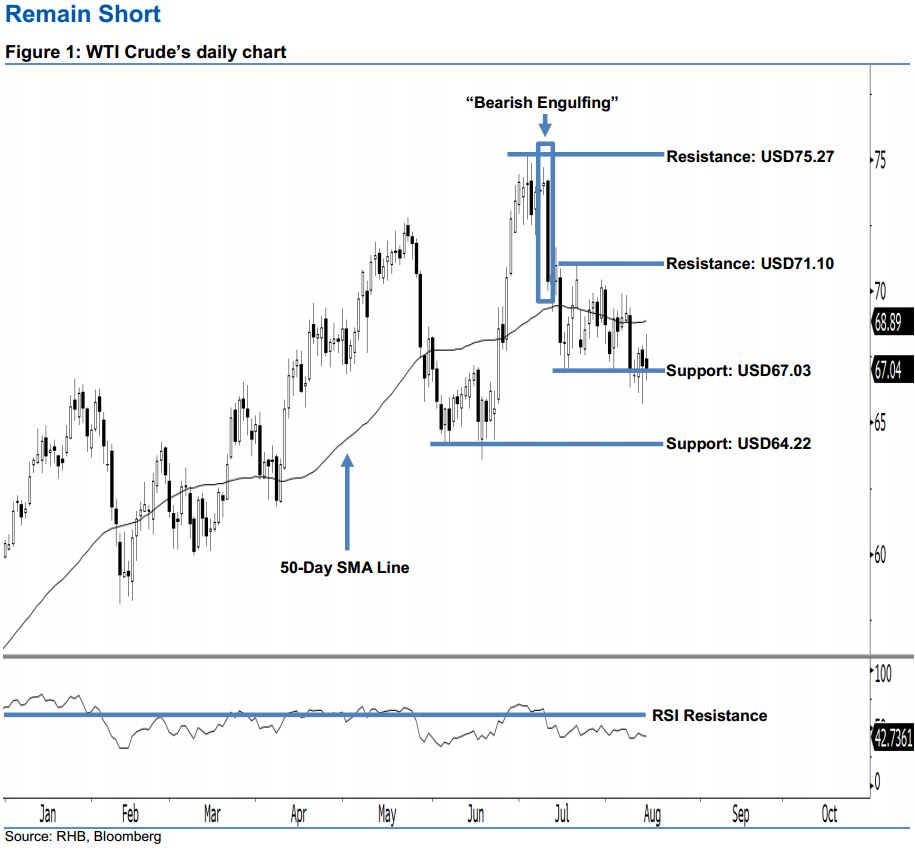

Keep in short positions in line with the ongoing bearish bias. Last night, the WTI Crude inched down USD0.16 to USD67.04, and left a black candle, indicating a bearish session. Presently, we make no change to our negative view, as no firm positive follow-through was sighted. At this juncture, the bearish bias in the appearance of the “Bearish Engulfing” candlestick pattern on 11 Jul remains firmly in play. We also highlight that the commodity is trading below the 50-day SMA line. This implies a weak outlook, which enhances our downside view.

Based on the daily chart above, we believe that more opportunities are still leaning towards the sellers. Having said so, it is best that traders maintain short positions, pegging a stop-loss above the USD71.10 mark to minimise the trading risk. Recall that we made the initial short recommendation below the USD72.83 threshold on 12 Jul.

We keep the immediate support at USD67.03, located at the low of 17 Jul. Should the WTI Crude slip below this level, the following support is at the USD64.22 threshold, the low of 5 Jun’s “Bullish Harami” pattern. Meanwhile, our immediate resistance is maintained at USD71.10, the high of 20 Jul. For the next resistance, look to USD75.27, ie 3 Jul’s high.

Source: RHB Securities Research - 15 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024