FBM Small Cap Index - Positive Expectations Ahead

rhboskres

Publish date: Thu, 16 Aug 2018, 05:18 PM

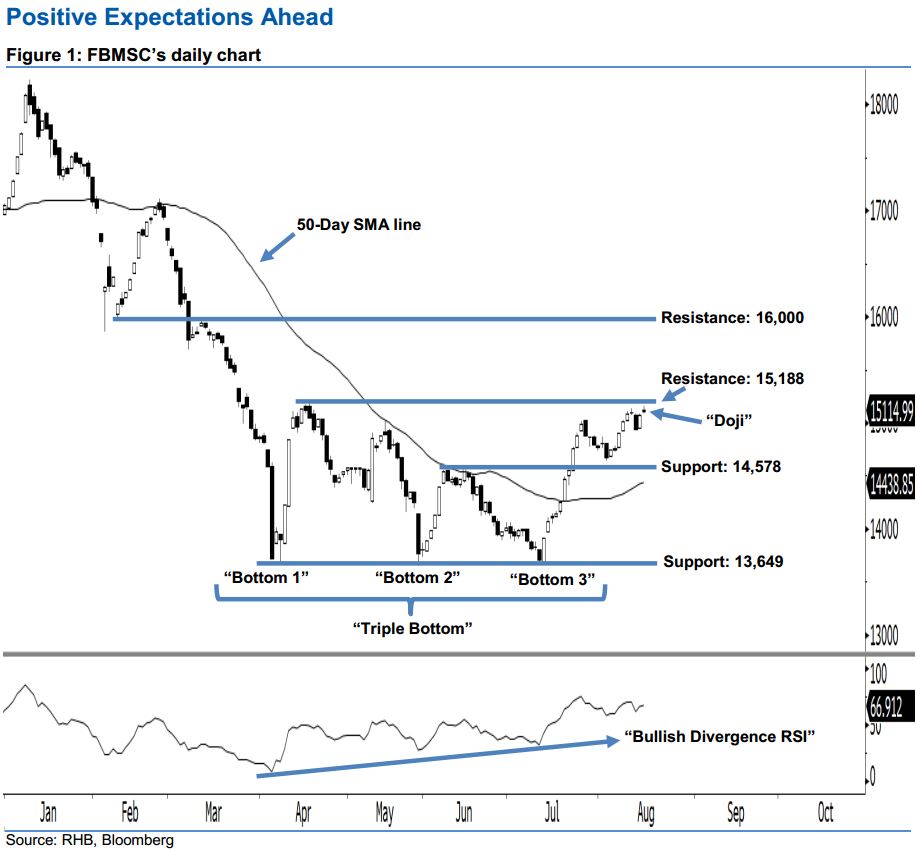

No end yet to the bullish bias of early April. The FBMSC inched up 46.94 pts yesterday to 15,114.99 pts. A “Doji” candlestick pattern was formed after the index hovered between a low of 15,079.57 pts and high of 15,157.64 pts – showing that neither bulls nor bears were able to take firm control at the end of the session. The FBMSC is now situated near the 15,188-pt resistance. Based on the current technical landscape, chances are high that the FBMSC may test this resistance in coming sessions. We note that the 50-day SMA line has also climbed by 46.94 pts to 15,114.99 pts, which implies a positive outlook and enhances our bullish view.

The bullish bias that started since early April remains in play. Initially, the appearance of 5 Apr’s “Bullish Harami” candlestick pattern was an early signal that the recent downtrend had reached its limit. This was also supported by last month’s “triple Bottom” and the “Bullish Divergence RSI” reversal patterns, which suggests the trend has moved towards the upside from the prior downside.

Our immediate support is maintained at 14,578 pts, which is located at the high of 14 Jun. The next support is pegged at 13,649 pts, or 30 May’s low. We set the immediate resistance at 15,188 pts, which was the high of 17 Apr. The following resistance is set at 16,000 pts – this is near the low and high of 9 Feb and 12 Mar.

Source: RHB Securities Research - 16 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024