WTI Crude Futures - Still Downbeat

rhboskres

Publish date: Fri, 17 Aug 2018, 09:52 AM

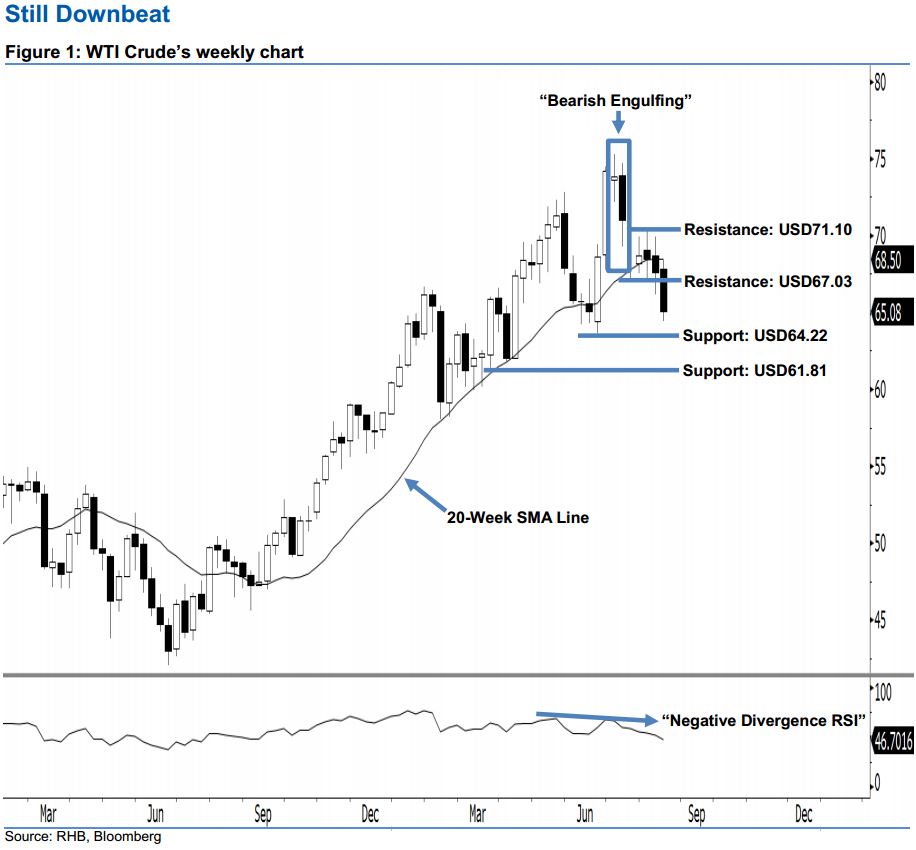

Keep in short positions as opportunities lean more towards the sellers. Today, we use weekly chart to analyse the WTI Crude. Presently, the bearish bias in the “Bearish Engulfing” candlestick pattern on 13 Jul continues to exert itself. This implies that the bears are still in firm control of the market. In addition, we also highlight that the commodity has dropped below the 20-week SMA line – an indication that investor sentiment is weak. Looking forward, we believe the correction may still be extended further. This is also supported by the “Negative Divergence RSI” reversal pattern, which suggests that the trend has shifted from the upside to the downside.

The current technical landscape suggests that more opportunities are leaning towards the sellers. Hence, we reiterate our short call with a stop-loss pegged above the USD71.10 threshold. This is so that the upside risk is kept at a minimum. Recall that we made the short call 12 Jul, after strong selling activities led the WTI Crude to close below USD72.83.

We keep the immediate support at USD64.22, located at the low of 5 Jun’s “Bullish Harami” pattern. If this level is breached, the following support is found at USD61.81, which was the low of 6 Apr. Towards the upside, the immediate resistance is pegged at USD67.03, or the low of 17 Jul. This is followed by the USD71.10 resistance mark, obtained from the high of 20 Jul.

Source: RHB Securities Research - 17 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024