Hang Seng Index Futures - a Weak Recovery

rhboskres

Publish date: Mon, 20 Aug 2018, 10:03 AM

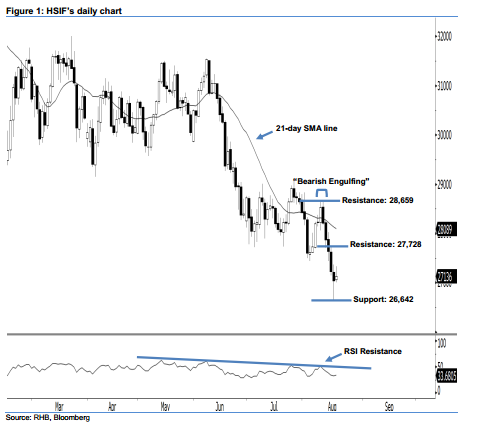

Stay short. After posting five consecutive black candles in a row, the HSIF ended higher to form a positive candle last Friday. It closed at 27,136 pts after having hovered between a high of 27,332 pts and low of 27,005 pts throughout the day. Unsurprisingly, last Friday’s positive candle should merely be viewed as the result of bargainhunting activities following the recent losses. On a technical basis, as the HSIF continues to stay below the declining 21-day SMA line, this suggests the downside swing from 10 Aug’s “Bearish Engulfing” pattern remains valid. Overall, we maintain our bearish view on the index’s near-term outlook.

As seen in the chart, we are eyeing the immediate resistance at 27,728 pts, ie the high of 15 Aug. If this level is taken out, look to 28,659 pts, which was the high of 10 Aug’s “Bearish Engulfing” pattern. To the downside, the immediate support is now anticipated at 26,642 pts – this was determined from the low of 16 Aug. Meanwhile, the next support is seen at the 26,000-pt psychological spot.

Therefore, we advise traders to stay short, following our recommendation of initiating short below the 27,728-pt level on 16 Aug. A stop-loss can be set above the 28,659-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 20 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024