FKLI & FCPO - FKLI: Gearing Towards 200-Day SMA

rhboskres

Publish date: Tue, 21 Aug 2018, 09:59 AM

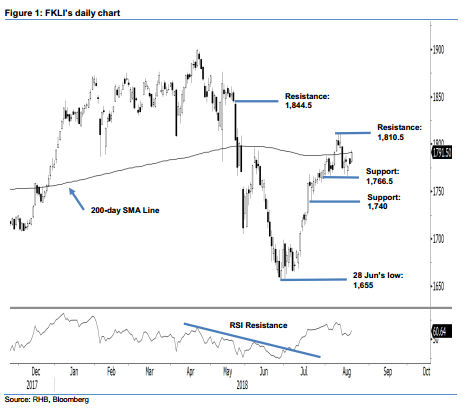

Maintain short positions as the correction is still developing. Yesterday, the FKLI performed positively, as it formed a white candle and ended the session marginally above the 200-day SMA line (current reading: 1,791 pts). Intraday, the index registered a low and high of 1,779.5 pts and 1,793.5 pts, before closing at 1,791.5 pts, – a gain of 12 pts. We do not deem the latest closing as a valid breakout from the 200-day SMA line, as it was not decisive. This implies the correction phase that has been in development since the high of 1,810.5 pts on 10 Aug is still ongoing. Hence, we keep to our near-term negative trading bias.

Given the correction phase since the recent high of 1,810.5 pts is likely to extend further, we continue to recommend that traders keep to short positions. We initiated these positions at 1,775 pts, the closing level of 13 Aug. For risk management purposes, a stop-loss can be set above 1,810.5 pts.

We maintain the immediate support at 1,766.5 pts, the low of 31 Jul. This is followed by 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is set at 1,810.5 pts, the highs of 9 and 10 Aug. The second resistance is expected at 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 21 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024