E-mini Dow Futures - Upside Swing Stays Intact

rhboskres

Publish date: Thu, 23 Aug 2018, 04:21 PM

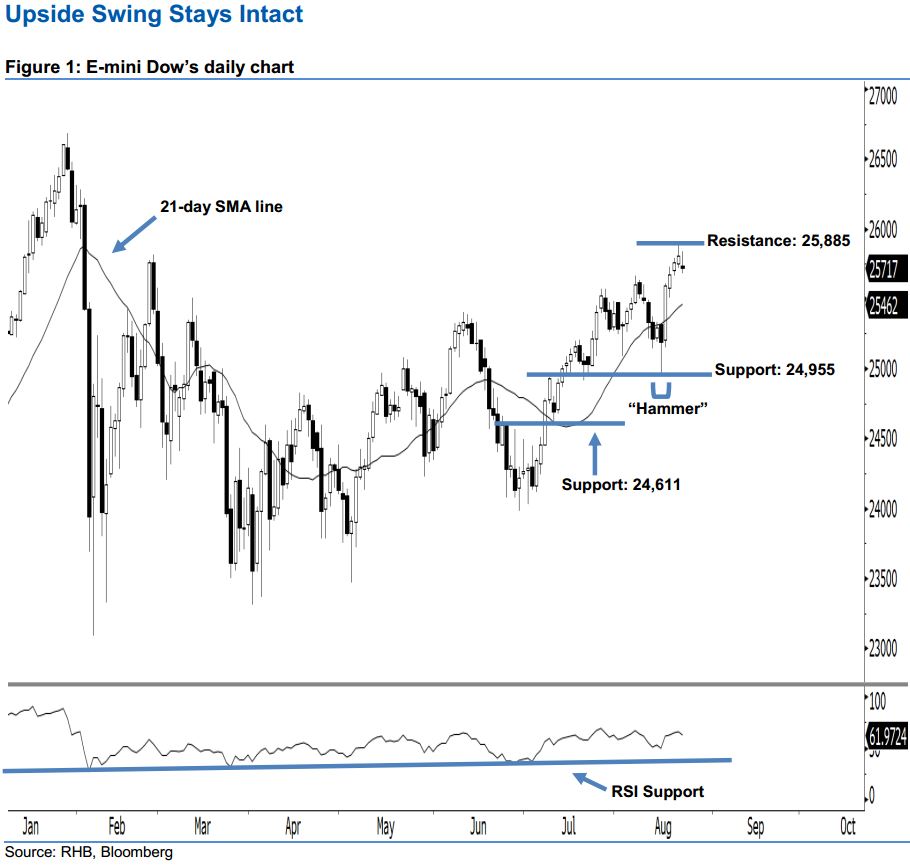

Stay long, with a trailing-stop set below the 24,955-pt support. After posting four white candles in a row, the E-mini Dow ended lower last night and formed a “Doji” candle. It settled at 25,717 pts after having hovered between a high of 25,836 pts and low of 25,677 pts throughout the day. However, yesterday’s “Doji” candle should merely indicate that the buyers may be taking a breather following the gains seen recently. With the 21- day SMA line still pointing upwards, this leads us to believe the rebound from 15 Aug’s “Hammer” pattern may continue. Overall, we remain bullish on the E-mini Dow’s near-term outlook.

Based on the daily chart, the immediate support is maintained at 24,955 pts – this is situated at the low of 15 Aug’s “Hammer” pattern. The next support is likely to be at 24,611 pts, which was the previous low of 11 Jul. On the other hand, we now anticipate the immediate resistance at 25,885 pts – this was defined from the high of 21 Aug. Meanwhile, the next resistance is seen at the 26,000-pt psychological mark.

As a result, we advise traders to maintain long positions, since we originally recommended that they initiate long above the 24,600-pt level on 11 Jul. In the meantime, a trailing-stop can be set below the 24,955-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 23 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024