Hang Seng Index Futures - Triggers Long Positions

rhboskres

Publish date: Thu, 23 Aug 2018, 04:23 PM

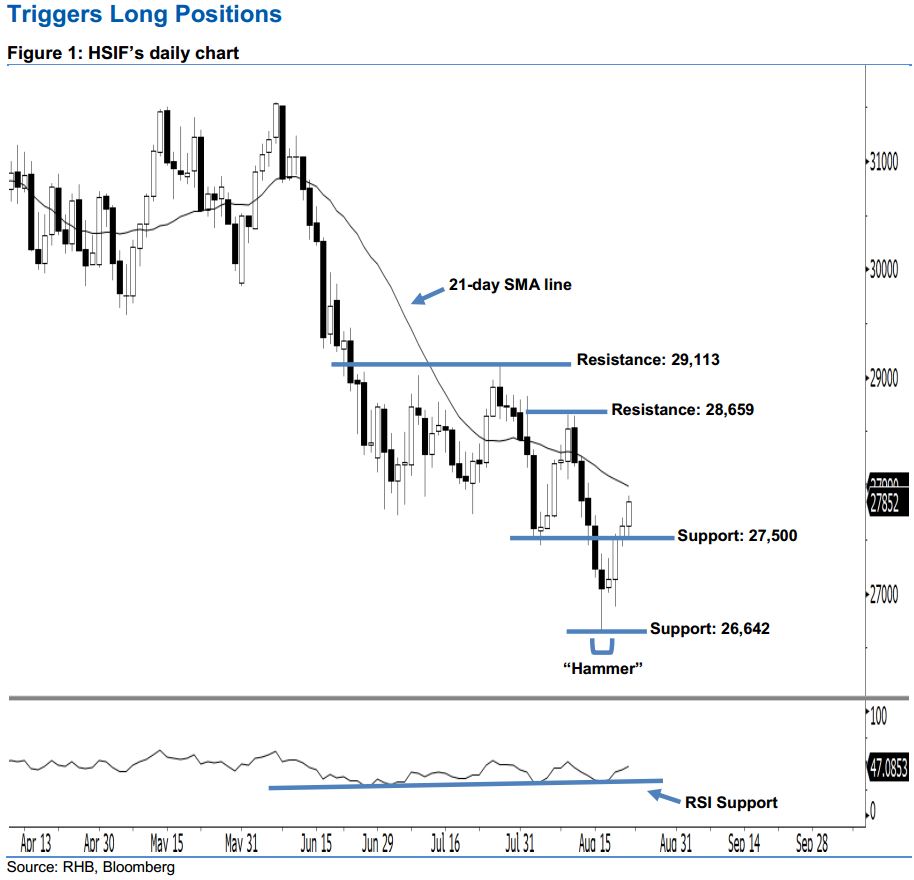

Initiate long positions above the 27,500-pt level. The HSIF formed a fourth consecutive white candle yesterday, indicating persistent buying momentum. It rose to a high of 27,907 pts during the intraday session before ending at 27,852 pts for the day. As the index has marked a higher close vis-à-vis the previous sessions since 17 Aug, this indicates that market sentiment is turning positive. Yesterday’s white candle can be viewed as a continuation of the bulls extending the rebound from 16 Aug’s “Hammer” pattern. Meanwhile, yesterday’s close also triggered our trailing-stop, which we previously recommended at the 27,728-pt threshold.

As seen in the chart, we are now eyeing the immediate support at 27,500 pts, which is situated near the low of 22 Aug. The next support is seen at 26,642 pts – this is determined from the low of 16 Aug’s “Hammer” pattern. Towards the upside, the immediate resistance is anticipated at 28,659 pts, ie the high of 9 Aug. If a breakout arises, look to 29,113 pts – ie the previous high of 26 Jul – as the next resistance.

Therefore, we advise traders to initiate fresh long positions above the 27,500-pt level. A stop-loss set below the 26,642-pt threshold is advisable in order to limit the downside risk.

Source: RHB Securities Research - 23 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024