FKLI & FCPO - FKLI: Crossing the 200-Day SMA Line

rhboskres

Publish date: Thu, 23 Aug 2018, 04:23 PM

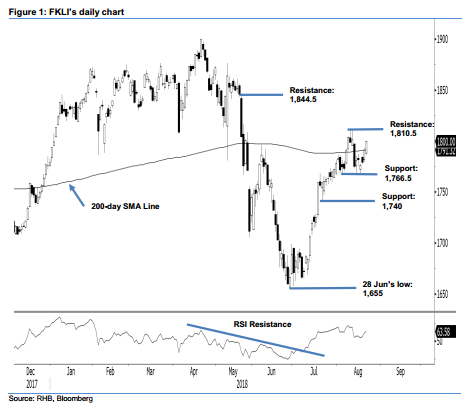

Maintain short positions. The FKLI’s latest session was led by the bulls. It formed a white candle which breached above the 200-day SMA line (current reading: 1791 pts), to close at 1,800 pts, implying a gain of 8.5 pts. The session’s low and high were recorded at 1,787 pts and 1,800.5 pts respectively. The recapturing of the 200- day SMA line is significant, as it suggests the possible return of the bulls’. Nevertheless, for confirmation of this, we believe the immediate resistance of 1,810.5 pts needs to be taken out. Until this happens, we keep to our negative near-term trading bias.

As we lean towards for the index’s correction to extend, we continue to advise traders to maintain short positions. We initiated these positions at 1,775 pts, the closing level of 13 Aug. For risk management purposes, a stop-loss can be set above 1,810.5 pts.

Towards the downside, the immediate support may be found at 1,766.5 pts, the low of 31 Jul. The second support is expected at 1,740 pts, the low of 20 Jul. Towards the upside, the immediate resistance is set at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 23 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024