FKLI & FCPO - FKLI: Immediate Resistance Still in Place

rhboskres

Publish date: Fri, 24 Aug 2018, 10:25 AM

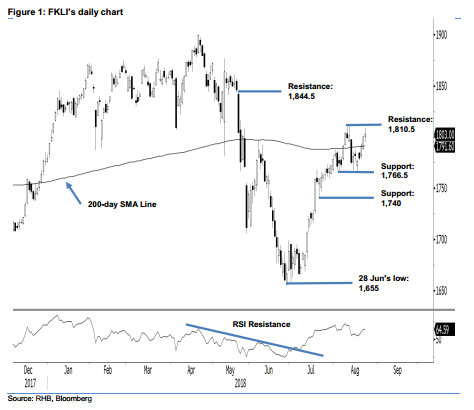

Maintain short positions as resumption of rally is not nigh. The FKLI’s latest session saw it situated between the immediate resistance of 1,810.5 pts and 200-day SMA line (current reading: 1,791 pts). For the session, the low and high were recorded at 1,795 pts and 1,808.5 pts, before it ended at 1,803 pts, implying a gain of 3 pts. While the index’s ability to stay above the 200-day SMA line is positive, we believe a firm break above the said immediate resistance is needed to confirm the correction phase – which has been developing in recent weeks – has indeed reached an end. Until this happens, we maintain our negative near-term trading bias.

In the absence of a price signal that could suggest the resumption of the rebound from the low of 28 Jun, we continue to advise traders to maintain short positions. We initiated these positions at 1,775 pts, the closing level of 13 Aug. For risk management purposes, a stop-loss can be set above 1,810.5 pts.

We maintain the immediate support at 1,766.5 pts, the low of 31 Jul. This is followed by 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is set at 1,810.5 pts, the highs of 9 and 10 Aug. The second resistance is at 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 24 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024