WTI Crude Futures - Stay in Short Positions

rhboskres

Publish date: Fri, 24 Aug 2018, 10:27 AM

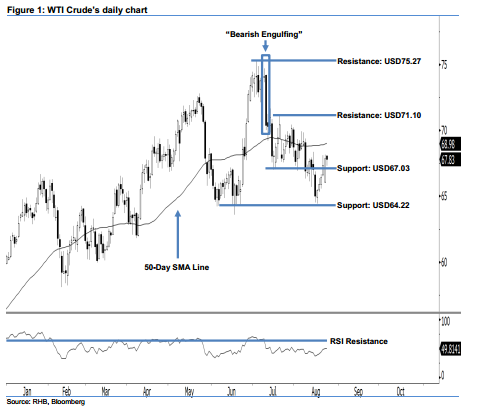

Best to stay in short positions as opportunities are still leaning towards the sellers. Last night, the WTI Crude slipped USD0.03 to USD67.88. It left a black candle after the commodity oscillated between a low of USD67.32 and high of USD68.12, which implied that the session was led by the sellers. Presently, we believe that the bearish bias that started since July is still in play, given that no strong upside development was sighted. From our technical perspective, the correction may still be extended in coming sessions.

The daily chart above shows that opportunities are still leaning more towards the sellers. As such, it is best that traders maintain short positions. In order to minimise the upside risk, we advise that investors set a stop-loss above the USD71.10 mark. This is in line with our short recommendation on 12 Jul, after the WTI Crude’s price dropped firmly below the USD72.83 mark.

Our immediate support is now at USD67.03, obtained from the low of 17 Jul. The next support is pegged at the USD64.22 threshold, which was the low of 5 Jun’s “Bullish Harami” pattern. Conversely, we set the immediate resistance at USD71.10, located at the high of 20 Jul. This is followed by the following resistance at the USD75.27, ie 3 Jul’s high.

Source: RHB Securities Research - 24 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024