SGX FTSE China A50 - Positive Expectation Continues

rhboskres

Publish date: Mon, 27 Aug 2018, 08:49 AM

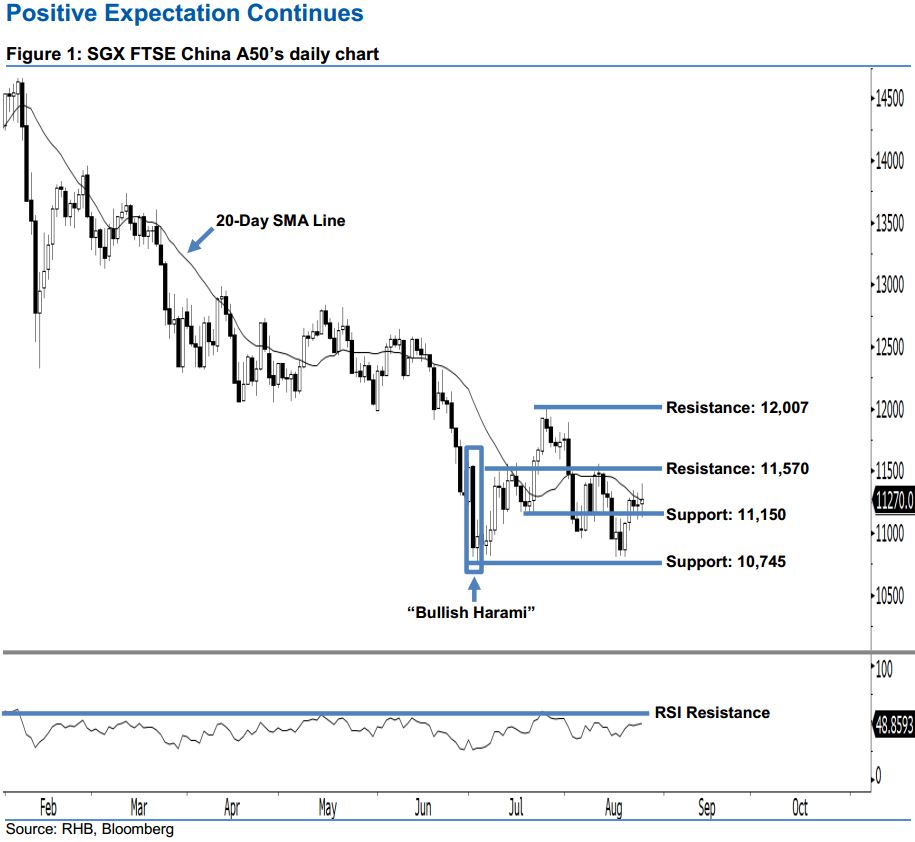

Keep in long positions, in line with the ongoing near 2-month upside bias. At the end of last Friday’s session, the SGX FTSE China A50 registered a 37.50-pt increase to 11,270 pts. We believe the bulls are presently dominating market sentiment. As long as the index continues to hover above the 10,745-pt mark, this implies that the bullish bias in 3 Jul’s “Bullish Harami” candlestick pattern remains in play. The current technical landscape suggests that the near 2-month upside development is resilient, thereby enhancing our positive view.

Based on the daily chart above, we think the bulls remain the dominant force. As such, it is best that traders maintain long positions with a cut-loss pegged below the 10,745-pt threshold. This is in order to minimise the downside risk. Recall that we made the initial long recommendation on 23 Jul. This was after the SGX FTSE China A50 successfully climbed above the 11,570-pt level.

To the downside, the immediate support is maintained at 11,150 pts, or the low of 20 Jul. This is followed by the next support at the 10,745-pt threshold, which was the low of 3 Jul’s “Bullish Harami” pattern. Conversely, we keep the immediate resistance at 11,570 pts, or 29 Jun’s high. For the next resistance, look to 12,007 pts, ie the high of 25 Jul.

Source: RHB Securities Research - 27 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024