WTI Crude Futures - Short Call Remains Intact

rhboskres

Publish date: Mon, 27 Aug 2018, 11:26 AM

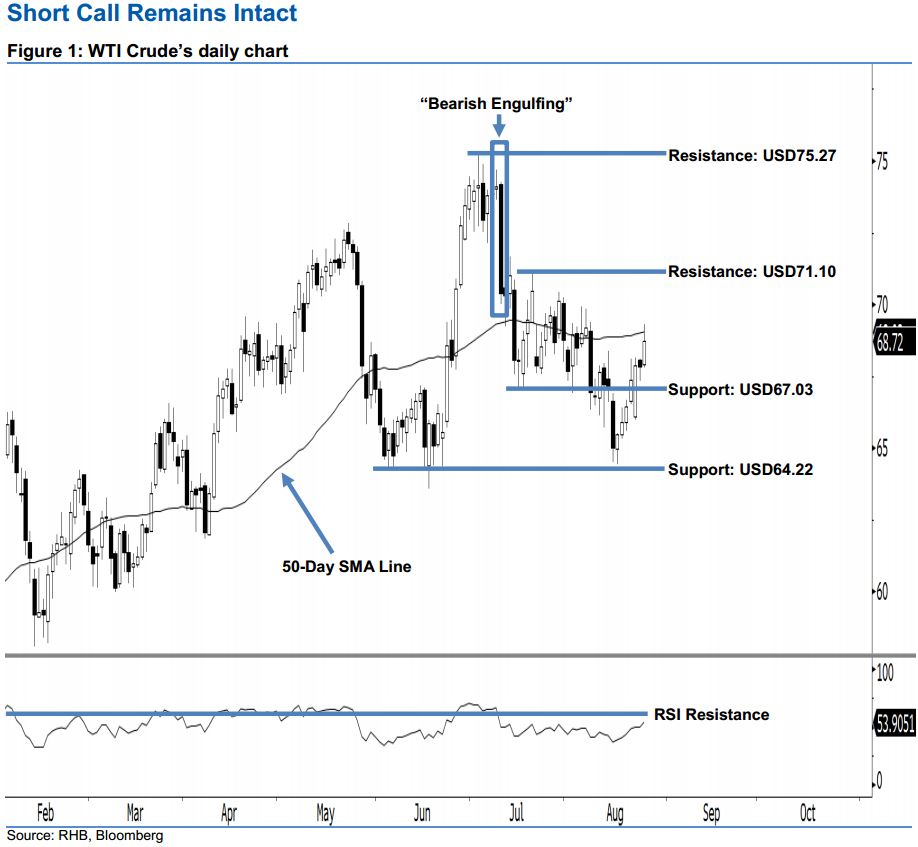

Keep short positions, in line with the ongoing bearish bias. The WTI Crude ended last Friday’s session at USD68.72, ie USD0.89 higher from the prior session of USD67.83. As a result, a white candle was formed, which implies that the session was led by the buyers. However, we make no change to our bearish view, as the commodity is still trading below our stop-loss of USD71.10. As long as this level is not taken out, we think that the bearish bias in 11 Jul’s “Bearish Engulfing” candlestick pattern is not fully negated yet.

As we do not see any strong upside development, this implies that the correction is still in play. Thus, we reiterate our short call with a stop-loss pegged above the USD71.10 mark. This is in order to minimise the upside risk. For the record, our short recommendation was made on 12 Jul, after a strong downside development occurred below the USD72.83 threshold.

Towards the downside, the immediate support is pegged at USD67.03, or the low of 17 Jul. The following support is found at USD64.22, ie the low of 5 Jun’s “Bullish Harami” pattern. On the flip side, our immediate resistance is maintained at the USD71.10 mark, obtained from the high of 20 Jul. The next resistance is set at the USD75.27 threshold, which was 3 Jul’s high.

Source: RHB Securities Research - 27 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024