COMEX Gold - Stay Short for Now

rhboskres

Publish date: Tue, 28 Aug 2018, 11:03 AM

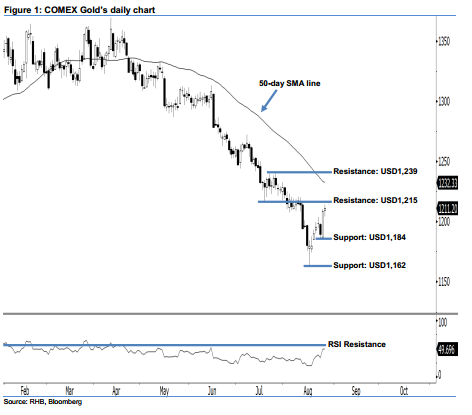

Stay in short positions as the current retracement is still in play. Last night, the COMEX Gold inched up USD2.60 to USD1,211.20, showing a continuation of the bullish bias we saw in the prior session. We are however maintaining our bearish view as the commodity is still unable to break above the USD1,215 resistance. At this juncture, we believe the retracement has not reached its limit yet. In addition, the fact that the 14-day RSI indicator is below the 50-pt neutral level at 49.70 pts suggests a negative outlook. This enhances our downside view.

As long as we do not see any strong upside development, this implies that the bears are still dominating market sentiment. Technically speaking, it is best that traders maintain short positions with a trailing-stop pegged above the abovementioned USD1,215. This is in order to secure part of the trading profits. Recall that our short call was initially made below the USD1,309 mark on 16 May.

We revise the immediate support at USD1,184, which was derived near the low of 24 Aug. This is followed by the next support at the USD1,162 threshold, ie the low of 16 Aug. Towards the upside, our immediate resistance is maintained at USD1,215, which is located at the low of 20 Jul’s “Bullish Engulfing” pattern. For the next resistance, look to USD1,239 resistance, or 26 Jul’s high.

Source: RHB Securities Research - 28 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024