FKLI & FCPO - FKLI: Bulls in Control

rhboskres

Publish date: Wed, 29 Aug 2018, 05:31 PM

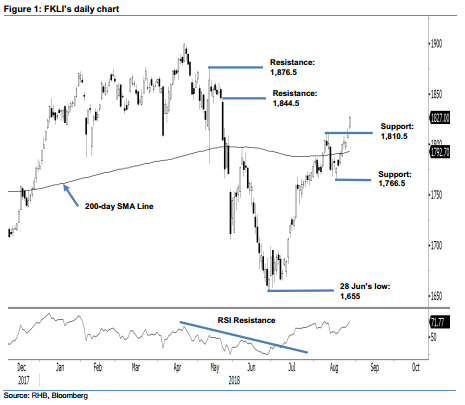

Maintain long positions. The FKLI ended the latest session positively, as it formed a white candle and ended 15 pts higher at 1,827 pts. The index generally trended higher throughout the session, with a low and high recorded at 1,815 pts and 1,828 pts. The positive session reinforces the view that the index is resuming its upward trend from the low of 1,655 pts on 28 Jun. Additionally, the index is trading rather comfortably above the 200-day SMA line. In the near term, as long as the immediate support of 1,810.5 pts is not breached, our positive bias would not be at risk.

With the index’s positive follow-through – after breaking out from its multi-week consolidation phase in the prior session – we continue to advise traders to maintain long positions. We initiated these positions at 1,812 pts, which is the closing level of 27 Aug. For risk management, a stop-loss below 1,766.5 pts is advisable.

The immediate support is pegged at 1,810.5 pts – the highs of 9 and 10 Aug. The second support is at 1,766.5 pts, the low of 31 Jul. On the other hand, the immediate resistance is expected at 1,844.5 pts, the high of 23 May. This is followed by 1,876.5 pts, the high of 14 May.

Source: RHB Securities Research - 29 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024