Hang Seng Index Futures - Near-Term Rebound Stays Intact

rhboskres

Publish date: Wed, 29 Aug 2018, 05:35 PM

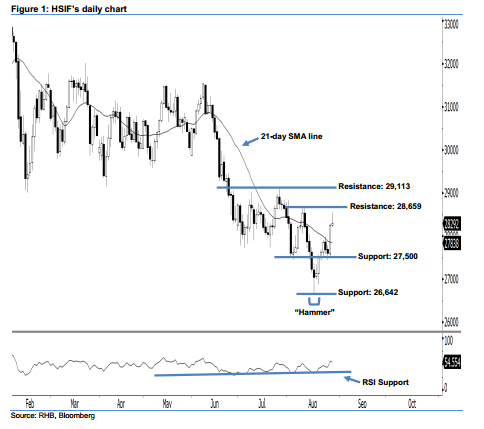

Stay long, while setting a new trailing-stop below the 27,500-pt support. The HSIF formed another positive candle yesterday. It rose to a high of 28,549 pts during the intraday session, before ending at 28,292 pts for the day. On a technical basis, we think the near-term rebound is still present for now, as the index has remained above the 21-day SMA line. Furthermore, the 14-day RSI indicator has recovered above the 50 neutral point to flash a bullish reading at 54.55 pts – this has enhanced the near-term positive sentiment. Overall, we remain positive on our near-term outlook.

According to the daily chart, we are eyeing the immediate support level at 27,500 pts, ie near the multiple lows of 2 Aug, 22 Aug and 27 Aug. The next support is maintained at 26,642 pts, determined from the low of 16 Aug’s “Hammer” pattern. On the other hand, the near-term resistance level is seen at 28,659 pts, obtained from the high of 9 Aug. This is followed by 29,113 pts – situated at the previous high of 26 Jul.

Hence, we advise traders to stay long, following our recommendation of initiating long above the 27,500-pt level on 23 Aug. For now, a new trailing-stop is preferably set below the 27,500-pt threshold as well, in order to minimise the risk per trade.

Source: RHB Securities Research - 29 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024