E-mini Dow Futures - Moving Higher

rhboskres

Publish date: Thu, 30 Aug 2018, 05:07 PM

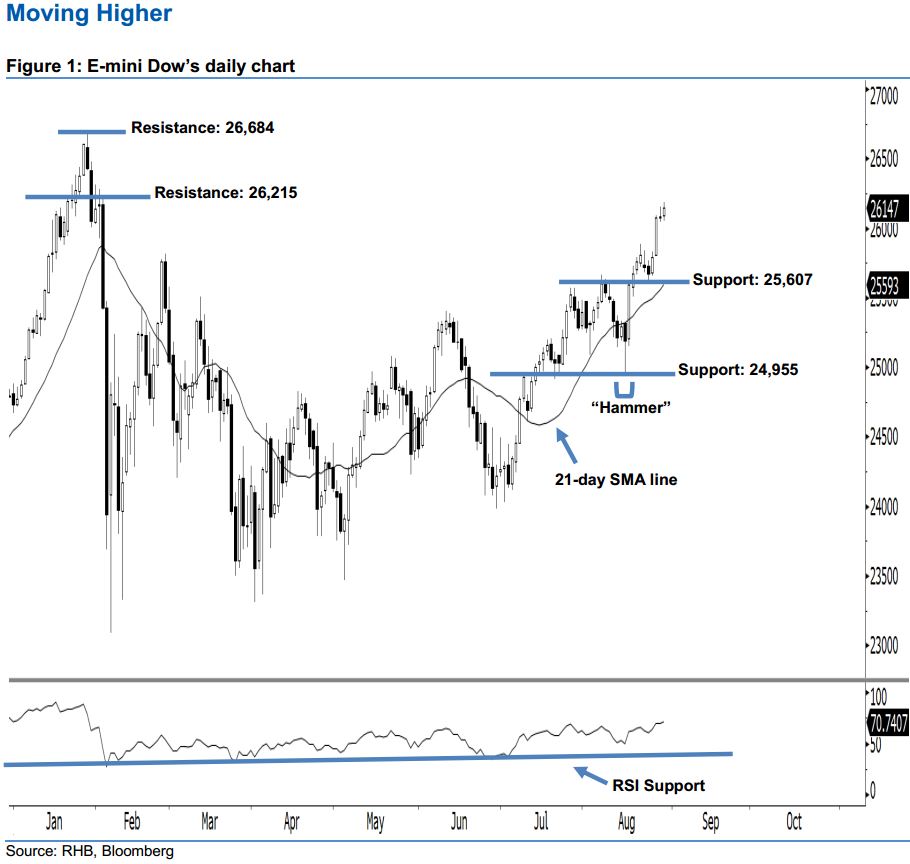

Stay long, with a trailing-stop set below the 25,607-pt support. The upward movement of the E-mini Dow continued as expected, as a white candle was formed last night. It rose 62 pts to close at 26,147 pts, off its high of 26,185 pts and low of 26,050 pts. Market sentiment remains bullish in the near term, as the index is still trading above the 21-day SMA line. This may also further extend the rebound from 15 Aug’s “Hammer” pattern. In view that the 21-day SMA line is likely to turn higher, the bullish sentiment has therefore been enhanced.

According to the daily chart, we are eyeing the immediate support level at 25,607 pts, which was the low of 23 Aug. If price breaks down, look to 24,955 pts – determined from the low of 15 Aug’s “Hammer” pattern – as the next support. On the other hand, we anticipate the immediate resistance level at 26,215 pts, ie the high of 2 Feb’s long black candle. Meanwhile, the next resistance is seen at the 26,684-pt historical high.

Hence, we advise traders to stay long, since we previously recommended initiating long above the 24,600-pt level on 11 Jul. In the meantime, a trailing-stop is advisable to set below the 25,607-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 30 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024