COMEX Gold - The Negative Sentiment Extends

rhboskres

Publish date: Thu, 30 Aug 2018, 05:08 PM

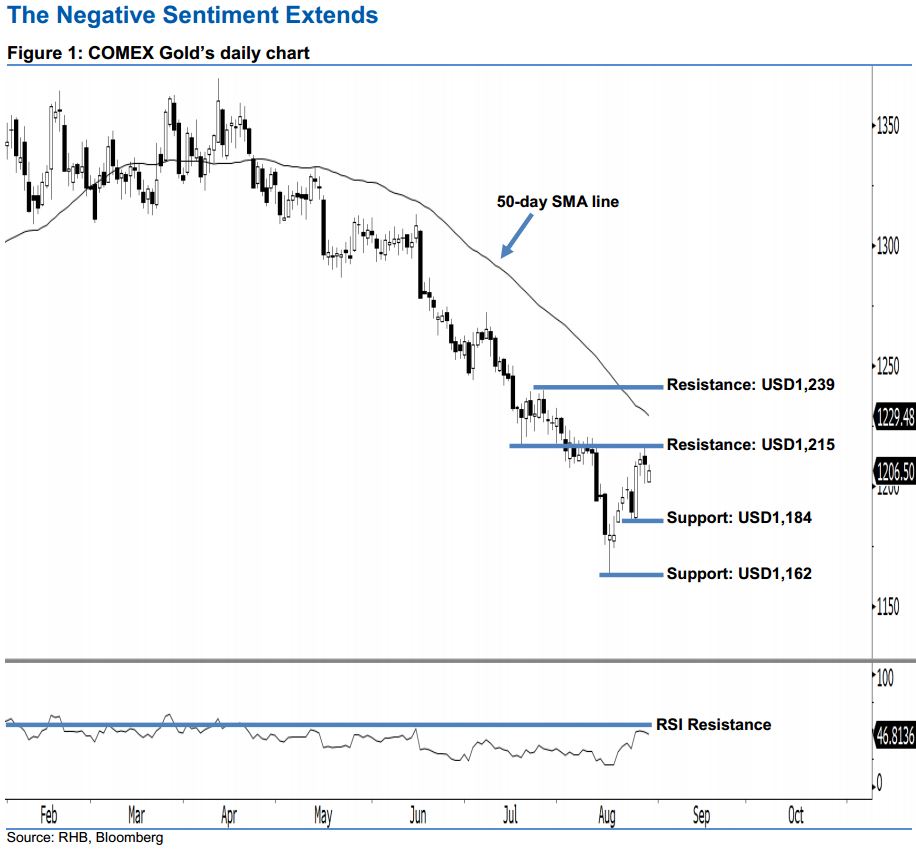

Maintain short positions, as the bulls are still unable to take firm control of the market. The COMEX Gold ended at USD1,206.50 last night, registering a USD3 loss. We do not presently see any strong upside development in the daily chart, which implies that the bulls are still unable to wrest control from the bears. This is given that the 14-day RSI indicator continues to fluctuate below the 50-pt neutral level at 46.81 pts. Our bearish view is also supported by the index being located below the 50-day SMA line, which implies a negative outlook.

Based on the daily chart above, we think the downside movement has not reached its limit yet. Technically speaking, it is still safe for traders to stay in short positions, with a trailing-stop pegged above the USD1,215 mark. This is so that parts of the trading profits are secured. For the record, our short call was triggered on 16 May after a strong bearish bias was observed below the USD1,309 threshold.

We set the immediate support at USD1,184, ie near the low of 24 Aug. This is followed by the next USD1,162 support, which was derived from the low of 16 Aug. On the flip side, our immediate resistance is maintained at USD1,215 – this is located at the low of 20 Jul’s “Bullish Engulfing” pattern. For the next resistance, look to USD1,239, or 26 Jul’s high.

Source: RHB Securities Research - 30 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024