WTI Crude Futures - Negative Expectation Continues

rhboskres

Publish date: Thu, 30 Aug 2018, 05:11 PM

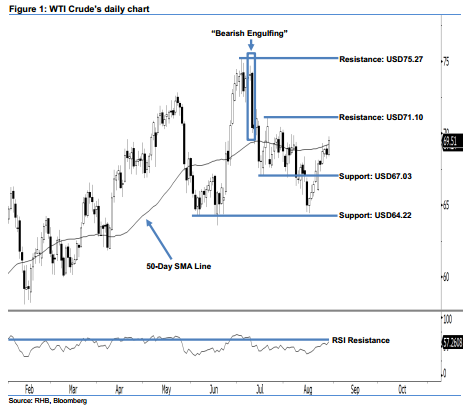

Still safe to stay short below USD71.10. Last night, the WTI Crude rebounded by USD0.98 to close at USD69.51. As a result, a white candle that breached above the 50-day SMA line was formed. However, our bearish view is still intact, as no firm upside development was sighted yet. At this juncture, we believe that the bearish bias in the “Bearish Engulfing” candlestick pattern on 11 Jul has not been fully negated yet. This is especially when the index is still unable to break above the USD71.10 mark, which implies that bears still dominate the market.

As long as no strong upside development emerges, we believe that the WTI Crude has not found its bottom yet. Thus, traders are advised to stay in short positions. A stop-loss can be set above USD71.10, so that trading risk is kept at a minimum. This is in line with our initial short recommendation on 12 Jul, after a firm breach below the USD72.83 threshold.

The USD67.03 mark, ie 17 Jul’s low, is kept as our immediate support. If this level is taken out, the next support is maintained at USD64.22, located at the low of 5 Jun’s “Bullish Harami” pattern. Conversely, the immediate resistance is at USD71.10, the high of 20 Jul. This is followed by the USD75.27 critical resistance threshold, or the high of 3 Jul.

Source: RHB Securities Research - 30 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024