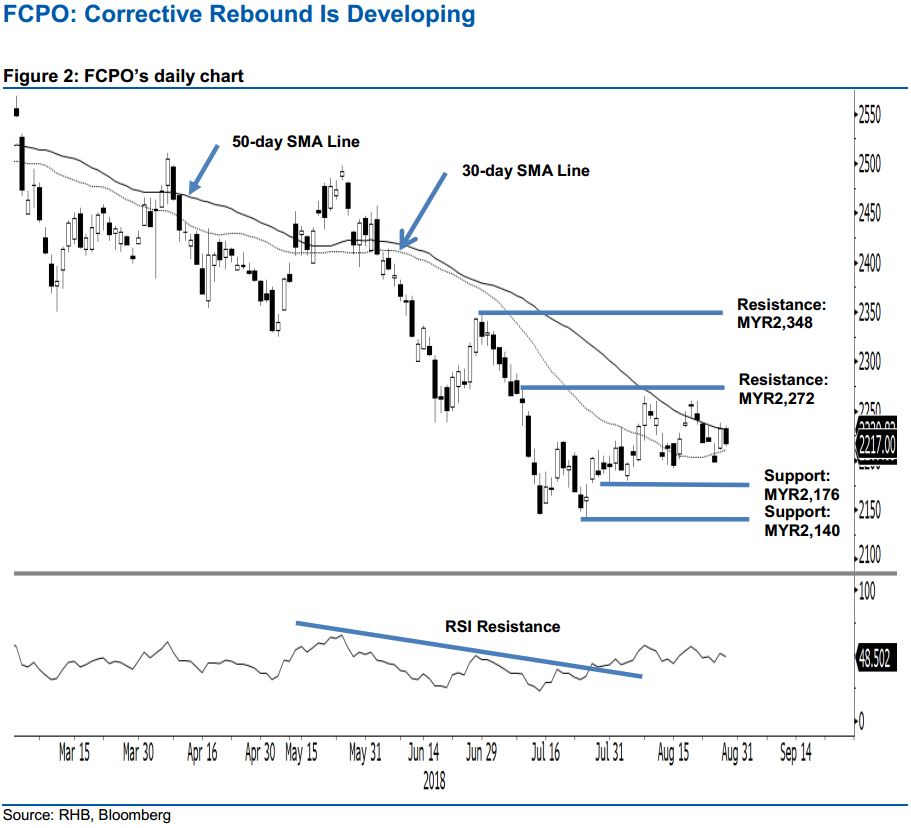

FCPO - Corrective Rebound Is Developing

rhboskres

Publish date: Thu, 30 Aug 2018, 05:12 PM

Maintain long positions. The FCPO weakened by MYR15 to close at MYR2,217 yesterday, marking a low and high of MYR2,214 and MYR2,234. This pushed the commodity to trade below the 50-day SMA line (current reading: MYR2,231). Nevertheless, the thesis for it to extend its corrective rebound from the low of MYR2,140 on 25 Jul is still valid, as the immediate support of MYR2,176 is still holding up. Hence, we maintain our near-term positive trading bias.

While the latest weak session has almost negated our previous day’s bias for the commodity to resume its rebound phase, we are not seeing signs of a YTD steep retracement coming back either. As such, we continue to recommend that traders maintain long positions – initiated at MYR2,211, or the closing level of 18 Jul. To manage risks, a stop-loss can be set at MYR2,176.

Immediate support is pegged at MYR2,176, the low of 31 Jul. The second support is expected to emerge at MYR2,140, the low of 25 Jul. On the other hand, the immediate resistance is expected at MYR2,272, or the high of 10 Jul. This is followed by MYR2,348, the high of 29 Jun.

Source: RHB Securities Research - 30 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024