FKLI - No Sign of a Reversal Yet

rhboskres

Publish date: Thu, 30 Aug 2018, 05:13 PM

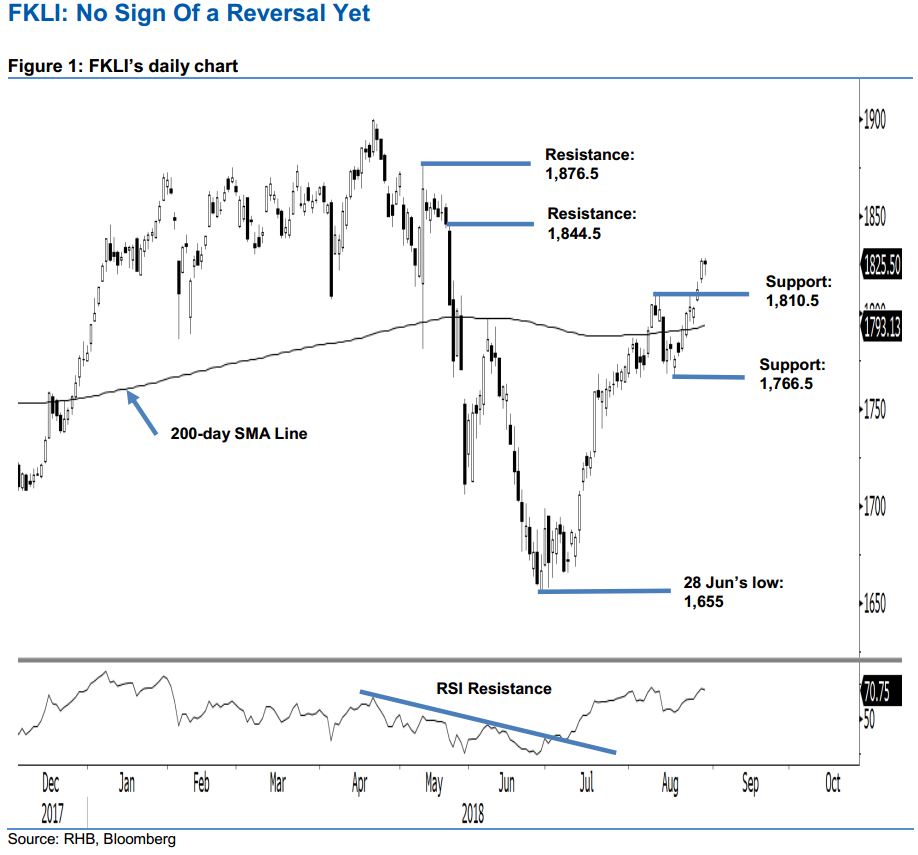

Maintain long positions, as there is no indication of a reversal. The FKLI closed neutrally yesterday, with the day’s low and high at 1,819 pts and 1,828 pts. It closed at 1,825.5 pts, implying a mild dip of 1.5 pts. This may point to a possible minor consolidation, after the recent uptrend in which it broke away from its multi-week consolidation zone on 27 Aug. As the index is comfortably above both the immediate support of 1,810.5 pts and the 200-day SMA line, this points to a upbeat picture. As such, we keep our positive near-term trading bias.

As the FKLI’s uptrend is still intact with no price reversal signals spotted, we continue to advise traders to maintain long positions. We initiated these positions at 1,812 pts, the closing level of 27 Aug. Investors can set a stop-loss below 1,766.5 pts to manage risks.

Towards the downside, immediate support is at 1,810.5 pts – the high of 9 and 10 Aug. This is followed by 1,766.5 pts, the low of 31 Jul. On the flip side, the immediate resistance is expected at 1,844.5 pts, the high of 23 May. This is followed by 1,876.5 pts, the high of 14 May.

Source: RHB Securities Research - 30 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024