WTI Crude Futures - Stay Short for Now

rhboskres

Publish date: Mon, 03 Sep 2018, 03:28 PM

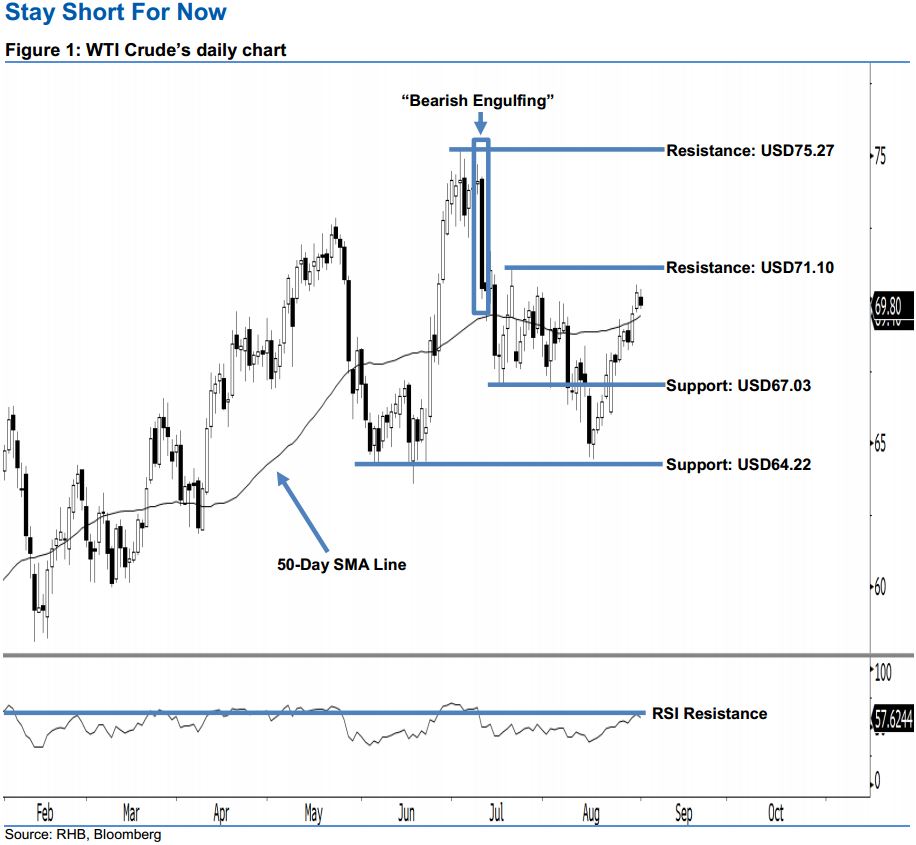

Keep in short positions as the bearish bias remains intact below USD71.10. At the end of last Friday’s session, the WTI Crude registered a USD0.45 loss to USD69.80. It formed a black candle after oscillating between a low of USD69.64 to USD70.36. Presently, we see the commodity continuing to trade below the USD71.10 mark. This implies that the bearish bias in the appearance of 11 Jul’s “Bearish Engulfing” candlestick pattern has not been fully negated yet. Technically speaking, the bears remain in dominance.

Based on the daily chart above, we believe that opportunities are still for the sellers. As such, there is no change to our short call. In order to minimise the upside risk, we advise setting a stop-loss above the USD71.10 mark. This is in line with our initial short recommendation on 12 Jul, following a strong downside development below the USD72.83 mark.

We keep the immediate support at USD67.03, which was the low of 17 Jul. The following support is maintained at the USD64.22 threshold, or the low of 5 Jun’s “Bullish Harami” pattern. On the flip side, our immediate resistance is set at USD71.10, ie the high of 20 Jul. If this level is taken out, the next resistance is seen at USD75.27, located at 3 Jul’s high.

Source: RHB Securities Research - 3 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024