COMEX Gold: More Opportunity for Sellers

rhboskres

Publish date: Mon, 03 Sep 2018, 03:38 PM

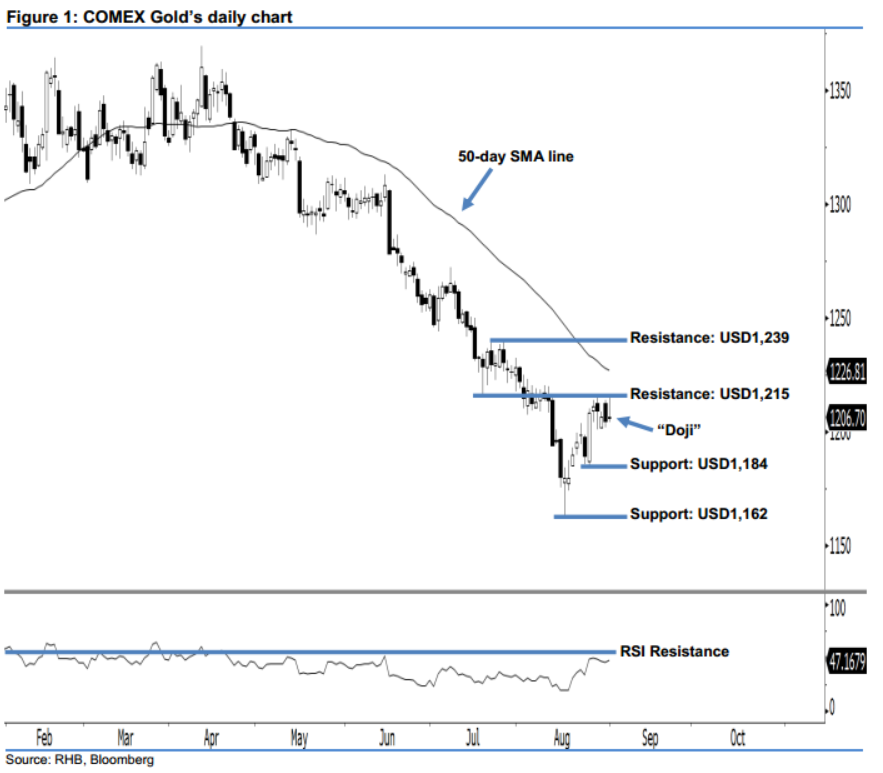

Short call remains valid, in line with the ongoing bearish bias. The COMEX Gold ended at USD1,206.70 and posted a USD1.70 loss last Friday. It left a “Doji” candlestick pattern after oscillating between a low of USD1,204.10 and high of USD1,214.90. This shows that neither bulls nor bears were able to take firm control at the end of the session. We do not see any strong upside development presently in the daily chart. From our technical perspective, this means the bulls are still unable to wrest control from the bears. Overall, our bearish view remains in play.

The current technical landscape suggests opportunities are still leaning more towards the sellers. As such, it is best that traders maintain short positions. In order to lock in part of the trading profits, we advise them to set a trailing-stop above the USD1,215 mark. This is in line with our initial short recommendation below the USD1,309 threshold on 16 May.

Our immediate support is maintained at USD1,184, which is near the low of 24 Aug. The following support is pegged at the USD1,162 mark, or the low of 16 Aug. Conversely, we set the immediate resistance at USD1,215, ie the low of 20 Jul’s “Bullish Engulfing” pattern. This is followed by the next resistance at the USD1,239 threshold, or the high of 26 Jul.

Source: RHB Securities Research - 3 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024