COMEX Gold: the Ongoing Downtrend

rhboskres

Publish date: Tue, 04 Sep 2018, 03:01 PM

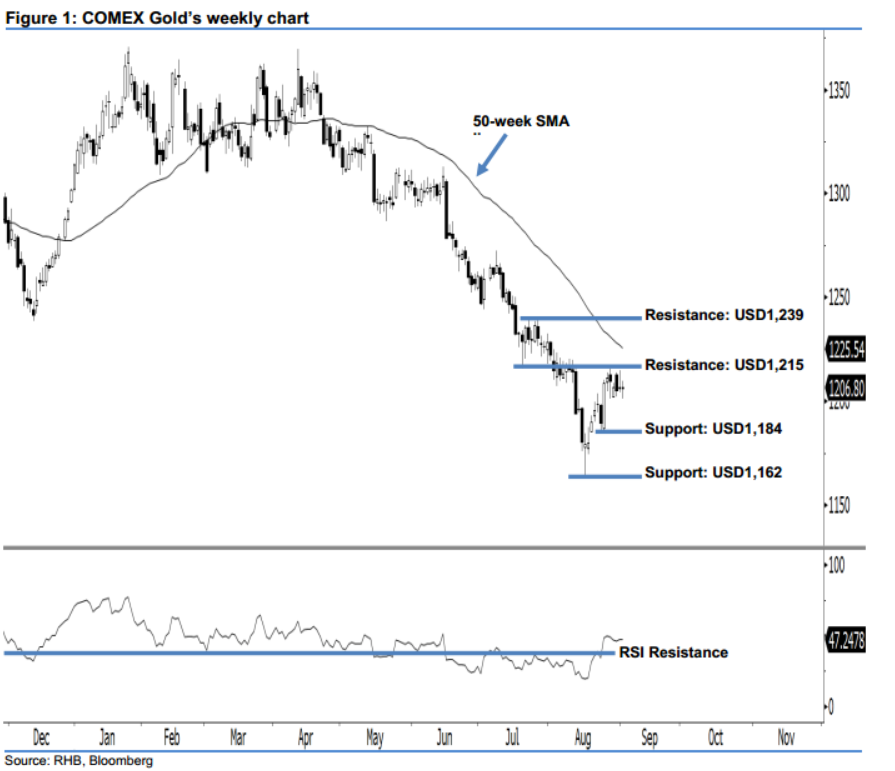

Keep short, as the current downtrend remains intact. Today we use weekly chart to analyse the COMEX Gold. Although we saw a developing positive momentum above the USD1,162 mark, no strong continuation has been sighted – which implies the current downtrend has not reached its limit yet. We note that the commodity continues to trade below the 50-week SMA line, which implies a negative outlook. In addition, the 14-week RSI indicator is still fluctuating below the 50-pt neutral level – an indication of weak sentiment. All these negative signals contribute to our downside view.

As such, we make no change to our short call, with a trailing-stop pegged above the USD1,215 threshold. This is in order to secure part of the trading profits. Recall that our initial short recommendation was made on 16 May, following a firm breach below the USD1,309 level.

To the downside, the immediate support stays at USD1,184, or the low of 24 Aug. For the next support, look to USD1,162, ie 16 Aug’s low. On the flip side, the immediate resistance is pegged at USD1,215, which is located at the low of 20 Jul’s “Bullish Engulfing” pattern. The following resistance is maintained at the USD1,239 threshold, or the high of 26 Jul.

Source: RHB Securities Research - 4 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024