COMEX Gold: the Downtrend Could Still Extend

rhboskres

Publish date: Wed, 05 Sep 2018, 12:40 PM

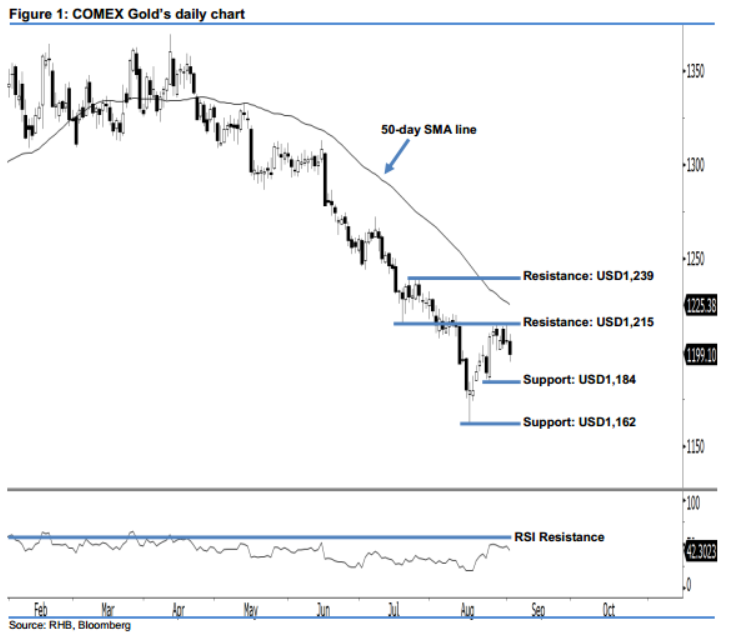

Stay short, as bearish expectations continue. The COMEX Gold registered a USD7.60 loss last night to USD1,199.10. A black candle was formed that implied the session was led by the sellers. As a result, the commodity dipped to a fresh 1-week low. Looking at the current technical landscape, we think the correction could still extend in the coming sessions. The fact that the COMEX Gold is trading below the 50-day SMA line points towards a negative outlook. Moreover, the 14-day RSI indicator is situated below the 50-pt neutral level at 42.30 pts, suggesting a lack of market strength. These bearish indicators contribute to our downside view.

As the downtrend is still in play, it is best that traders maintain short positions. In order to secure part of the trading profits, we advise setting a trailing-stop above the USD1,215 mark. For the record, we initially made the short call on 16 May. This was after the strong downside development below the USD1,309 threshold.

We set the immediate support at USD1,184, ie near the low of 24 Aug. Should the commodity slip below this level, the following support is found at the USD1,162 mark, which was 16 Aug’s low. Towards the upside, the immediate resistance is seen at USD1,215, or the low of 20 Jul’s “Bullish Engulfing” pattern. For the next resistance, look to USD1,239, ie 26 Jul’s high.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024