FBM Small Cap Index: May Still Climb Up

rhboskres

Publish date: Wed, 05 Sep 2018, 02:56 PM

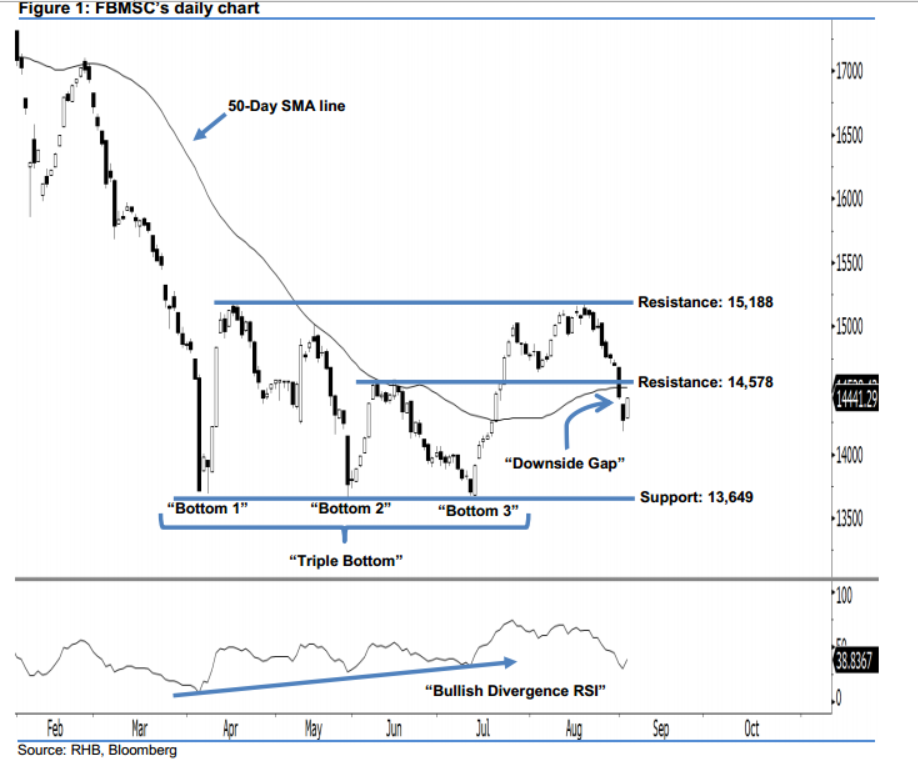

The positive view since April is still intact. After six declines in a row, the FBMSC finally rebounded by 173.17 pts yesterday to 14,441.29 pts. It charted a white candle without any upper shadow that closed the “Downside Gap” we saw on 3 Sep. This could be an early signal that the breather below 15,188 pts is nearing its limit. Based on the immediate positive momentum, chances are high that the index may continue go up in later sessions. Overall, our positive view since early April remains firmly in play.

Judging from the current technical landscape, we believe the bullish bias above 13,649 pts remains in play. This is especially after the appearance of the meaningful “Triple Bottom” and “Bullish Divergence RSI” reversal patterns in July, which suggested that the trend had changed to the upside from downside.

To the downside, our immediate support is maintained at 13,649 pts, or the low of 30 May. This is followed by the next support at 13,116 pts, which was 25 Aug 2015’s low. Conversely, we set the immediate resistance at 15,188 pts – this is located at the high of 17 Apr. The next resistance is pegged at the 15,188-pt mark, which was derived from 17 Apr’s high.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024