Hang Seng Index Futures: Rebound Resumes

rhboskres

Publish date: Wed, 05 Sep 2018, 02:59 PM

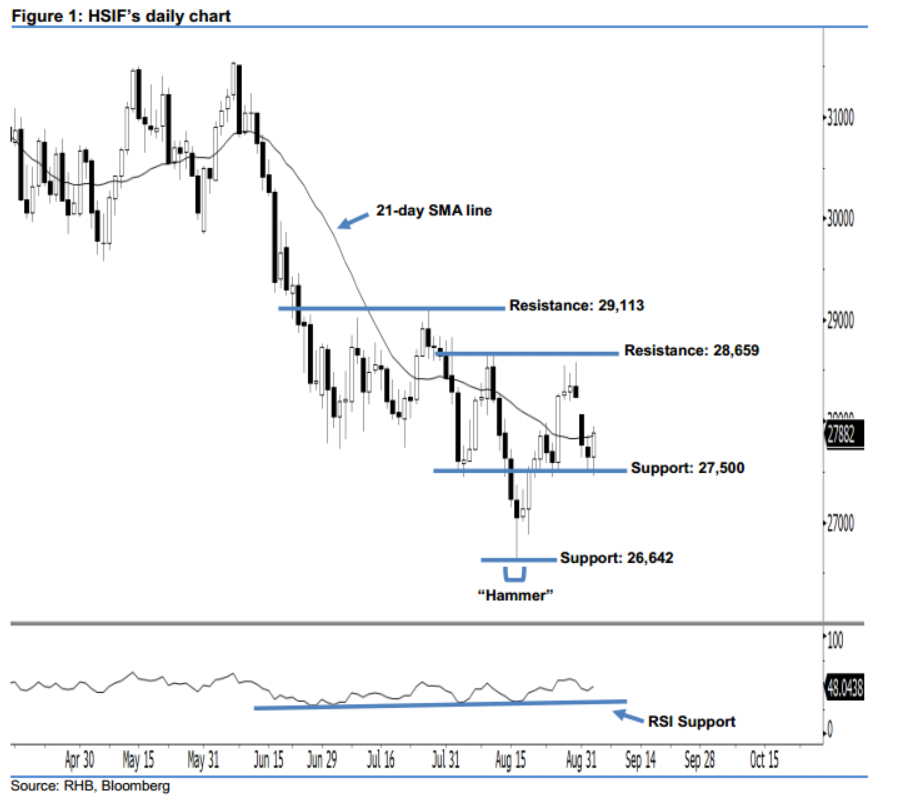

Stay long while setting a trailing-stop below the 27,500-pt support. The HSIF formed a white candle yesterday. During the intraday session, it rose to a high of 27,950 pts before ending at 27,882 pts for the day. From a technical viewpoint, the rebound is likely to continue in the near term. This was after the index recouped the previous day’s losses and climbed above the 21-day SMA line. With the 21-day SMA line now likely to turn upwards, this has led us to believe that the rebound that started off 16 Aug’s “Hammer” pattern may continue. Overall, we remain positive on the HSIF’s near-term outlook.

As seen in the chart, we are eyeing the immediate support at 27,500 pts, determined near the multiple lows of 2 Aug, 22 Aug and 27 Aug. If a decisive breakdown arises, the crucial support is maintained at 26,642 pts, which was the low of 16 Aug’s “Hammer” pattern. On the other hand, we maintain the near-term resistance at 28,659 pts, ie the high of 9 Aug. This is followed by 29,113 pts, situated at the previous high of 26 Jul.

Hence, we advise traders to maintain long positions, following our recommendation to initiate long above the 27,500-pt level on 23 Aug. Meanwhile, a trailing-stop is advisable below the 27,500-pt threshold, in order to minimise the risk per trade.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024