WTI Crude Futures - Still Safe to Stay Short

rhboskres

Publish date: Wed, 05 Sep 2018, 03:10 PM

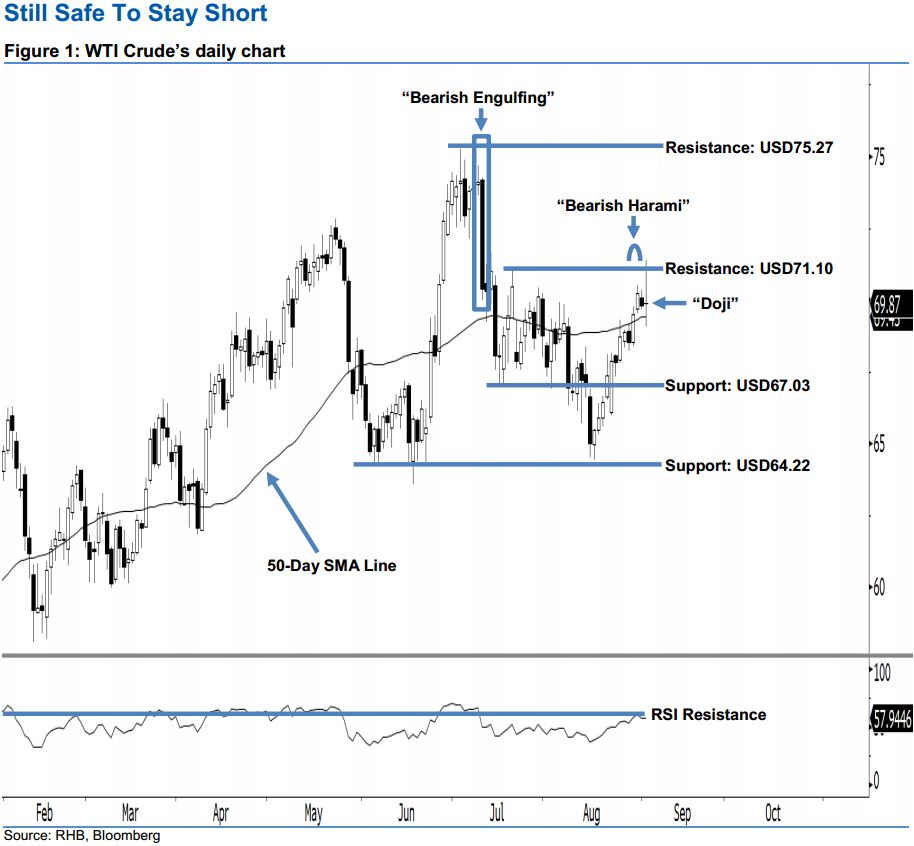

Maintain short positions, as bearish bias is still in play below the USD71.10 mark. Last night, the WTI Crude posted a USD0.07 gain to USD69.87. During the session, the commodity rose to its intraday high of USD71.40 and tested the USD71.10 resistance mark. Nevertheless, the positive momentum did not sustain, which finally led to the formation of the “Doji” candlestick pattern. This shows that the session was an indecisive one. Technically speaking, as long as the aforementioned resistance is not taken out, we think the bearish bias in 11 Jul’s “Bearish Engulfing” candlestick pattern remains intact. At this juncture, the bears are still in control of market sentiment.

Hence, it is best that traders maintain short positions. In order to minimise upside risk, we advise setting a stoploss above the USD71.10 threshold. This is in line with our short recommendation below the USD72.83 mark on 12 Jul.

The USD67.03 mark, ie 17 Jul’s low, is still our immediate support. Should the WTI Crude slip below this level, the following support is found at the USD64.22 threshold, which was the low of 5 Jun’s “Bullish Harami” pattern. On the flip side, we keep the immediate resistance at USD71.10, located at the high of 20 Jul. For the next resistance, look to USD75.27, or 3 Jul’s high.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024