FKLI - Bullish Perspective Continues

rhboskres

Publish date: Wed, 05 Sep 2018, 03:13 PM

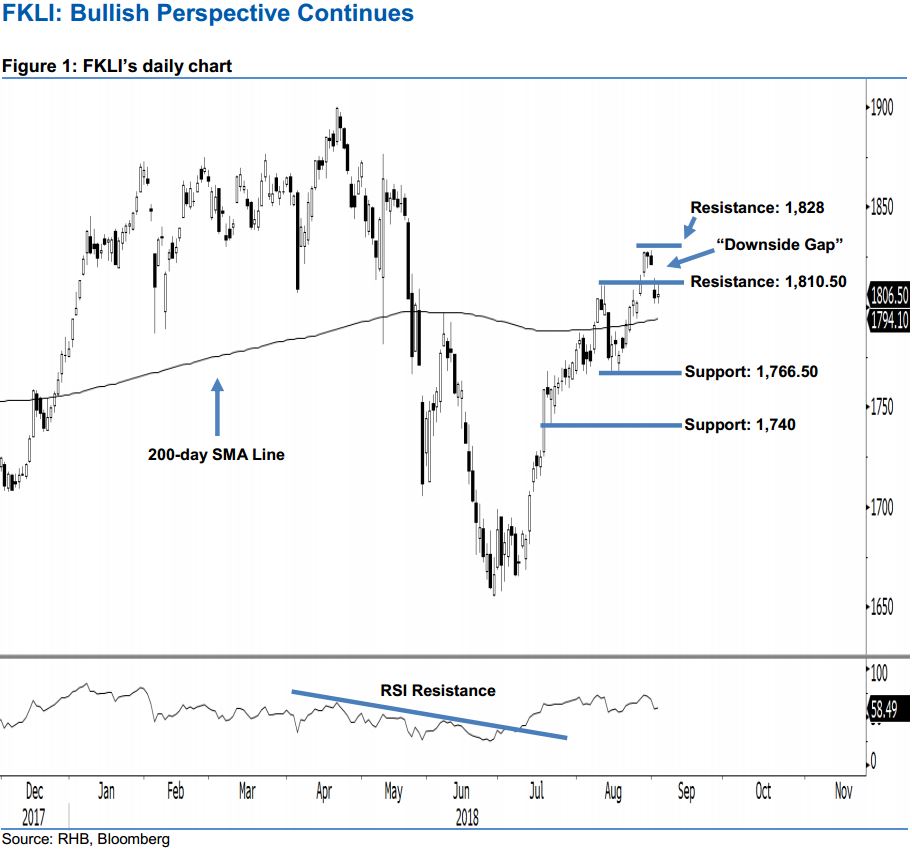

It is best to stay in long positions in lieu of the ongoing bullish bias. After three weak performances and dropping below the 1,810.50-pt mark on 3 Sep, the FKLI finally rebounded by 1.50 pts to 1,801.50 pts yesterday. This shows no continuation of the bearish bias we detected in the prior session. Overall, the bulls are still in play, and the uptrend is likely to be extended once the breather below 1,828 pts ends. Note that the 14-day RSI indicator is also hovering above the 50-pt neutral level at 58.49 pts. This implies a positive outlook, thereby enhancing our positive view.

Based on the daily chart above, we think that the buyers are still in control of market sentiment. Thus, we reiterate our long recommendation. In order to minimise the downside risk, we advise setting a stop-loss below the 1,766.50-pt mark. Recall that we initially made the long call at 1,812 pts, ie the closing level of 27 Aug.

We keep the immediate support at 1,766.5 pts, obtained from the low of 31 Jul. The following support is pegged at the 1,740-pt mark, or the low of 20 Jul. Towards the upside, our immediate resistance is maintained at 1,810.5 pts, ie the highs of 9 and 10 Aug. If this level is taken out, the next resistance is pegged at 1,828 pts, which was the high of 29 Aug.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024