FCPO - Expect More Increase Ahead

rhboskres

Publish date: Wed, 05 Sep 2018, 03:15 PM

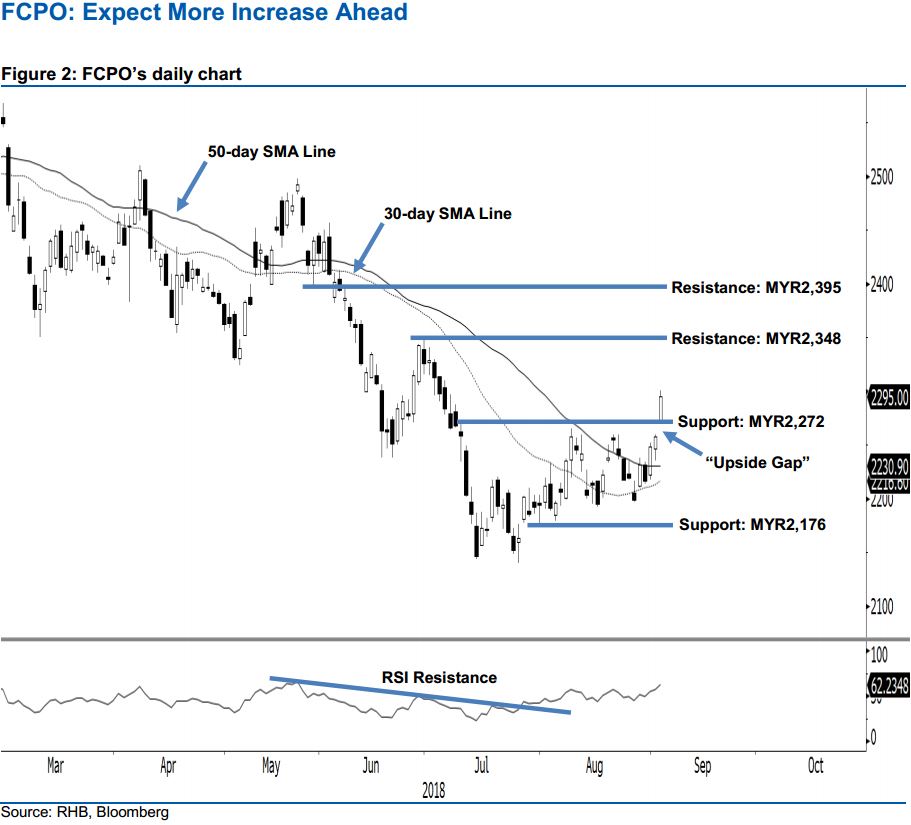

Continue to stay in long positions given that bullish bias is still exerting itself. The FCPO extended its climb, as it posted a MYR37 gain to MYR2,295 yesterday. The commodity formed a white candle and left the “Upside Gap” pattern. This shows that the session was led by the buyers, and the bullish bias is likely to be extended in the coming sessions. In terms of strength, the bulls are in dominance of market sentiment. This is given that the 14-day RSI indicator is currently hovering firmly above the 50-pt neutral level at 62.23 pts. Overall, we make no change to our positive view.

The current technical landscape suggests that the near 7-week upside bias is still exerting itself. As such, traders are advised to maintain their long positions. For risk-minimisation purposes, we advise setting a stop-loss at MYR2,176. This is in line with our initial long recommendation, which was initiated at MYR2,211, ie the closing level of 18 Jul.

We revise the immediate support to MYR2,272, ie the high of 10 Jul. This is followed by the next support at the MYR2,176 mark, which was the low of 31 Jul. Conversely, our immediate resistance is pegged at MYR2,348 mark, obtained from the high of 29 Jun. The next resistance is set at the MYR2,395 threshold, obtained from the low of 30 May.

Source: RHB Securities Research - 5 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024