COMEX Gold - Multi-Quarter Correction Mode

rhboskres

Publish date: Wed, 12 Sep 2018, 09:58 AM

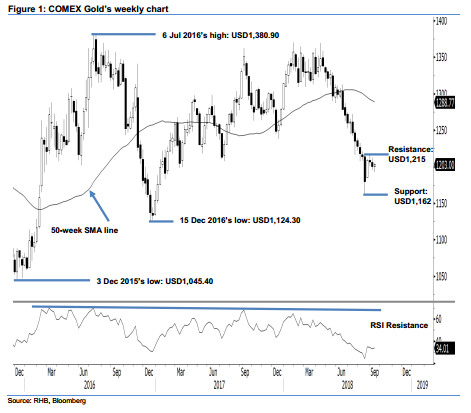

No signs of escape from the medium-term sideways consolidation; keep short positions. Today, we visit the COMEX Gold medium-term price trend. The trend started from the low of USD1,045.40 on 3 Dec 2015. The commodity made an impulsive upmove from that low point to a high of USD1,380.90 on 6 Jul 2016. Since then, it has been in a multi-quarter correction mode, possible in the form of a sideways correction pattern – which we see as still ongoing. This implies that the multi-quarter correction mode may ultimately retest the low of USD1,124.30 posted on 15 Dec 2016 to complete said pattern. In the near term, observe some form of a relief rebound developing, as its recent months’ retracement reached an oversold level. However, until we see signs for further rebound taking place, we keep to our near-term negative trading bias

Given that there is still no clear sign that a deeper corrective rebound is developing, we continue to advise traders to maintain short positions. We initiated these positions on 16 May after a strong downside development below USD1,309. For risk management purposes, we revise the trailing-stop to above USD1,207.06, the high of 6 Sep.

Immediate support is pegged at USD1,184, 24 Aug’s low. This is followed by USD1,162, which was the low of 16 Aug. On the other hand, immediate resistance is expected to appear at USD1,215, the low of 20 Jul. This is followed by USD1,239, or 26 Jul’s high.

Source: RHB Securities Research - 12 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024