Hang Seng Index Futures - Charts Another Black Candle

rhboskres

Publish date: Wed, 12 Sep 2018, 09:59 AM

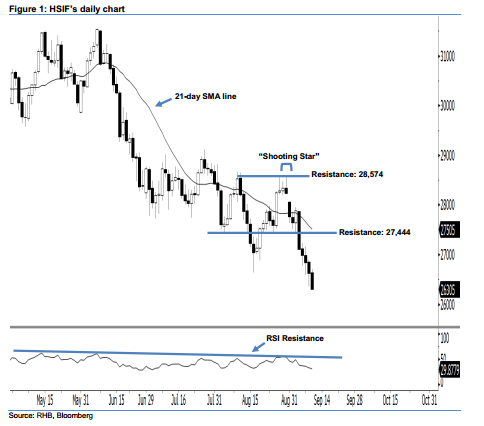

Stay short while setting a new trailing-stop above the 27,444-pt resistance. The downside momentum of the HSIF continued as expected, as a black candle was formed yesterday. During the intraday session, it dropped to a low of 26,290 pts before ending at 26,305 pts for the day. As the HSIF has successfully taken out the 26,642-pt support mentioned previously, this can be viewed as the bears extending their selling momentum. In view of the fact that the index has posted a black candle for the fifth consecutive session, this indicates that the downside swing that started off 30 Aug’s “Shooting Star” pattern may go on.

As seen in the chart, we are now eyeing the immediate resistance level at 27,444 pts, situated near the midpoint of 5 Sep’s long black candle. Meanwhile, the next resistance is seen at 28,574 pts, ie the high of 30 Aug’s “Shooting Star” pattern. Towards the downside, we anticipate the near-term support level at the 26,000-pt psychological mark. This is followed by 25,110 pts, which was the previous low of 5 Jul 2017.

Thus, we advise traders to stay short, since we had originally recommended initiating short below the 27,520-pt level on 6 Sep. For now, a new trailing-stop is advisable to set above the 27,444-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 12 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024