FKLI & FCPO - FKLI: Rebound at Risk

rhboskres

Publish date: Thu, 13 Sep 2018, 04:55 PM

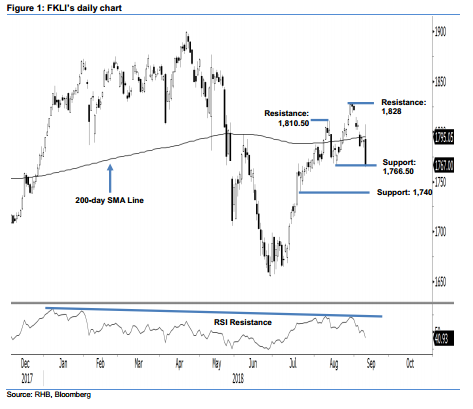

Maintain long positions as long as immediate support is still holding firm. The FKLI formed a black candle in the latest session and, in the process, saw its immediate support of 1,766.5 pts tested. The index failed to maintain its positive opening as it slipped lower throughout the session. The high and low were recorded at 1,807 pts and 1,764.5 pts, before it closed at 1,767 pts, indicating a decline of 24 pts. The weak session also means the 200-day SMA line is now decisively broken. However, as mentioned before, as long as the said immediate support is not broken at the closing, we will maintain our near-tem positive trading bias.

Premised on the above, we continue to advise traders to maintain their long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – which is also the closing level of 27 Aug.

We continue to set the immediate support at the 1,766.50-pt mark, ie 31 Jul’s low. This is followed by 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is set at 1,810.5 pts, which are the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 13 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024