COMEX Gold - Looking for a Deeper Rebound

rhboskres

Publish date: Thu, 13 Sep 2018, 05:08 PM

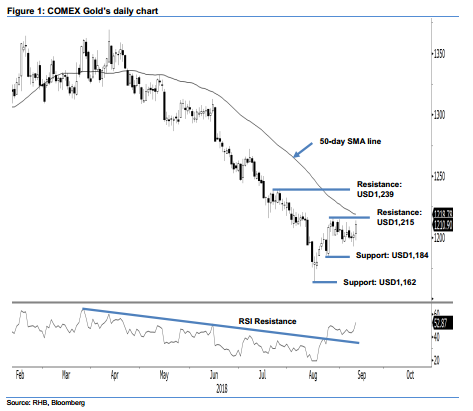

Initiate long positions as deeper rebound may be developing. The COMEX Gold formed a white candle in the latest session and ended USD8.70 higher at USD1,210.90. This came after it generally trended higher throughout the session, with the low and high registered at USD1,197.60 and USD1,213.90. The commodity has also breached above the USD1,207.60 threshold. We see this as a positive signal that the commodity is likely to extend its corrective rebound – set in after the recent multi-month (bottomed on 24 Aug) retracement reached an oversold level. The price pattern that developed over the last two weeks is also indicating the commodity is showing signs of base building to test the 50-day SMA line – which, if happens, may lend further support to the positive bias. Hence, we switch our near-term trading bias to positive.

Our previous short positions initiated on 16 May after a strong downside development below USD1,309 were closed out at USD1,207.06. With the expectation that a further rebound may develop, we initiate long positions on the commodity. For risk management, a stop-loss can be set at below USD1,184.

The immediate support is set at USD1,184, the low of 24 Aug’s low. The second support may emerge at USD1,162, which was the low of 16 Aug. Towards the upside, immediate resistance is expected to appear at USD1,215, the low of 20 Jul. This is followed by USD1,239, or 26 Jul’s high.

Source: RHB Securities Research - 13 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024