Hang Seng Index Futures - Snaps Five-Day Losing Streak

rhboskres

Publish date: Thu, 13 Sep 2018, 05:09 PM

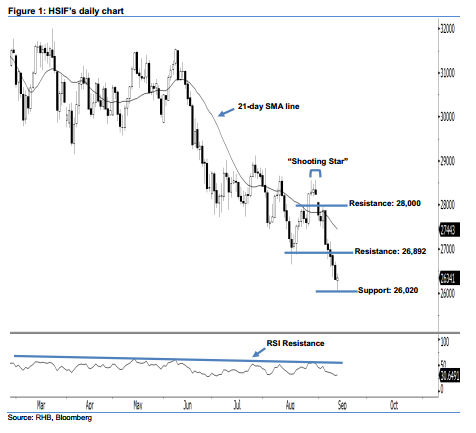

Maintain short positions. After posting five consecutive black candles in a row, the HSIF ended higher to form a positive candle yesterday. It closed at 26,341 pts, off its high of 26,436 pts and low of 26,020 pts. Unsurprisingly, yesterday’s positive candle should merely be viewed as the result of bargain-hunting activities following the recent losses. On a technical basis, as the HSIF continues to stay below the declining 21-day SMA line, this implies that the downside swing from 30 Aug’s “Shooting Star” pattern remains valid. Overall, we maintain our bearish view on the index’s near-term outlook.

According to the daily chart, the near-term resistance level is seen at 26,892 pts, set near 20 Aug’s low and 10 Sep’s high. This is followed by the 28,000-pt psychological spot. To the downside, we are now eyeing the immediate support level at 26,020 pts, which was the low of 12 Sep. Meanwhile, the next support is maintained at 25,110 pts, determined from the previous low of 5 Jul 2017.

To re-cap, on 6 Sep, we initially recommended traders to initiate short positions below the 27,520-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 26,892-pt threshold. This is in order to lock in part of the gains.

Source: RHB Securities Research - 13 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024