WTI Crude Futures - Bulls Are Trying to Gain Control

rhboskres

Publish date: Thu, 13 Sep 2018, 05:11 PM

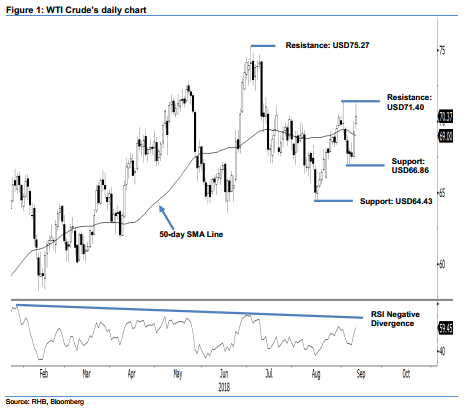

Maintain short positions. The bulls were in control over the WTI in the latest trading session. A white candle, which at the closing breached above the 50-day SMA line (current reading: USD69), was formed. The black gold closed USD1.12 higher at USD70.37 – the low and high were USD69.50 and USD71.26. Despite the positive price action, we continue to expect the commodity to develop some form of correction/consolidation pattern, which started from early July. This came in after its prior multi-quarter advancement reached an overbought level and triggered a negative divergence in the RSI reading. As long as the immediate resistance of USD71.40 is not breached to the upside, the negative bias would still be in place. Based on this, we are keeping our near-term negative trading bias.

Given that there is no price confirmation that a deeper rebound is developing, we continue to advise traders to keep to their short positions. To recap, we opened these short positions on 12 Jul, after the WTI Crude plunged below USD72.83. For risk management, a stop-loss can now be placed above USD71.40.

We set our eyes at USD66.86, the low of 7 Sep as our immediate support. Breaking this may see the market fall back to USD64.43, the low of 16 Aug. On the flip side, immediate resistance is now pegged at USD71.40, the high of 4 Sep. This is followed by USD75.27, the high of 3 Jul.

Source: RHB Securities Research - 13 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024