WTI Crude Futures - Keep to Short Positions

rhboskres

Publish date: Fri, 07 Sep 2018, 11:52 AM

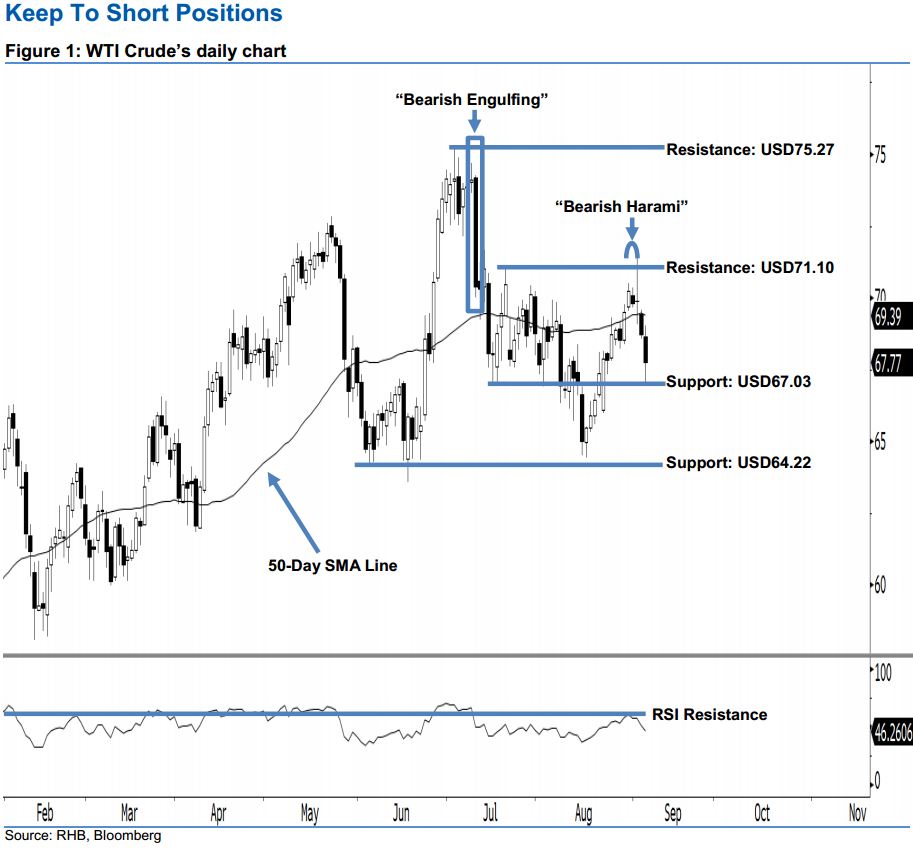

Maintain short positions in line with the ongoing bearish bias. Last night, the WTI Crude inched down USD0.95 to USD67.77. It charted a black candle after oscillating between a low of USD67 and high of USD69.02. This shows that the session was led by the sellers. As long as the commodity is unable to break above USD71.10, we think that the bears are still dominating market sentiment. Moreover, we note that the WTI Crude is trading below the 50-day SMA line. From our technical perspective, this implies a weak outlook, thereby enhancing our downside view.

In the absence of any strong upside development, this implies that the bearish bias since July has not been fully negated yet. Thus, we reiterate our short call with a stop-loss pegged above the USD71.10 threshold. This is in order to minimise the upside risk. For the record, we made the short call on 12 Jul, after the WTI Crude plunged below USD72.83.

The USD67.03 mark, ie 17 Jul’s low, is maintained as our immediate support. This is followed by the next support at the USD64.22 threshold, or the low of 5 Jun’s “Bullish Harami” pattern. Conversely, we set the immediate resistance at USD71.10, which was the high of 20 Jul. The next resistance is pegged at the USD75.27 mark, obtained from 3 Jul’s high.

Source: RHB Securities Research - 7 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024