WTI Crude Futures - Negative Bias Still in Place

rhboskres

Publish date: Fri, 14 Sep 2018, 04:54 PM

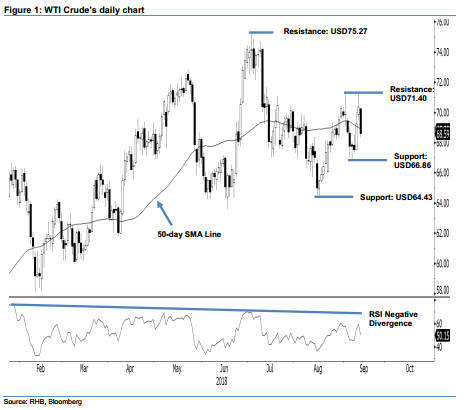

Bulls are still not able to control the trend; maintain short positions. The WTI performed weakly in the latest session as it formed a black candle – indicating the bears were in control. Intraday, the mood was negative as it slipped lower throughout the session – from a high of USD70.28 to a low of USD68.35, before ending the day USD1.78 lower at USD68.59. In the near term, we expect the bias for the commodity to remain negative. This is due to our anticipation that the multi-week correction that started from early July is still ongoing. This correction phase set in after the commodity reached a 2.5 year high of USD75.27 on 3 Jul. This triggered an overbought reading in the RSI. Towards the downside, a decisive break of the immediate support of USD66.86 – which is located near the 200-day SMA line – may suggest a deeper retracement to develop.

With the correction phase that started from early Jul not showing signs of ending, we continue to advise traders to keep to their short positions. To recap, we opened these short positions on 12 Jul, after the WTI Crude plunged below USD72.83. For risk management, a stop-loss can now be placed above USD71.40.

Towards the downside, the immediate support is pegged at USD66.86, the low of 7 Sep. The second support is at USD64.43, the low of 16 Aug. On the other hand, immediate resistance is now pegged at USD71.40, the high of 4 Sep. The following resistance is at the USD75.27 mark, the high of 3 Jul.

Source: RHB Securities Research - 14 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024