COMEX Gold - Positive Bias Still in Place

rhboskres

Publish date: Tue, 18 Sep 2018, 09:27 AM

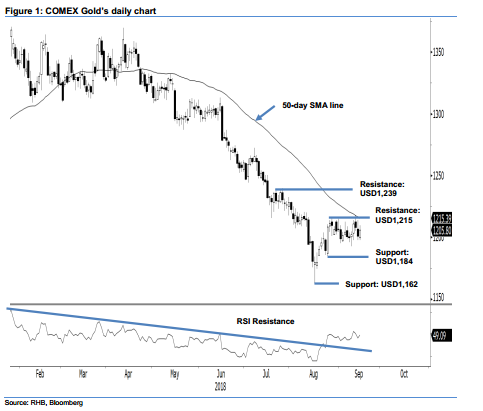

Maintain long positions. The COMEX Gold formed a white candle in the latest session – as it gained USD4.70 to close at USD1,205.80. Session’s low and high were recorded at USD1,197.50 and USD1,209.70. While the commodity is still not able to breach above both the 50-day SMA line and immediate resistance of USD1,215, we continue to observe it price movements over the past three weeks are showing characteristics of a consolidation before the next possible upward move. Moreover, as long as the immediate support of USD1,184 is not invalidated, the risk for the YTD deep retracement to return would still be low. Hence, we are maintaining our positive near-term trading bias.

The corrective rebound that started from the low of USD1,162 on 16 Aug – which set in after its prior multi-month deep retracement reached an oversold level – is still showing sign of developing. We continue to advise traders to keep to long positions on the commodity. We initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For risk management, a stop-loss can be set at below USD1,184.

Towards the downside, first support is expected at USD1,184, the low of 24 Aug. This is followed by an even more critical support of USD1,162, registered on 16 Aug – also the YTD low. Towards the upside, immediate resistance is at USD1,215, the low of 20 Jul. This is followed by USD1,239, or 26 Jul’s high.

Source: RHB Securities Research - 18 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024