COMEX Gold - Bulls Are Still Hibernating

rhboskres

Publish date: Wed, 19 Sep 2018, 04:36 PM

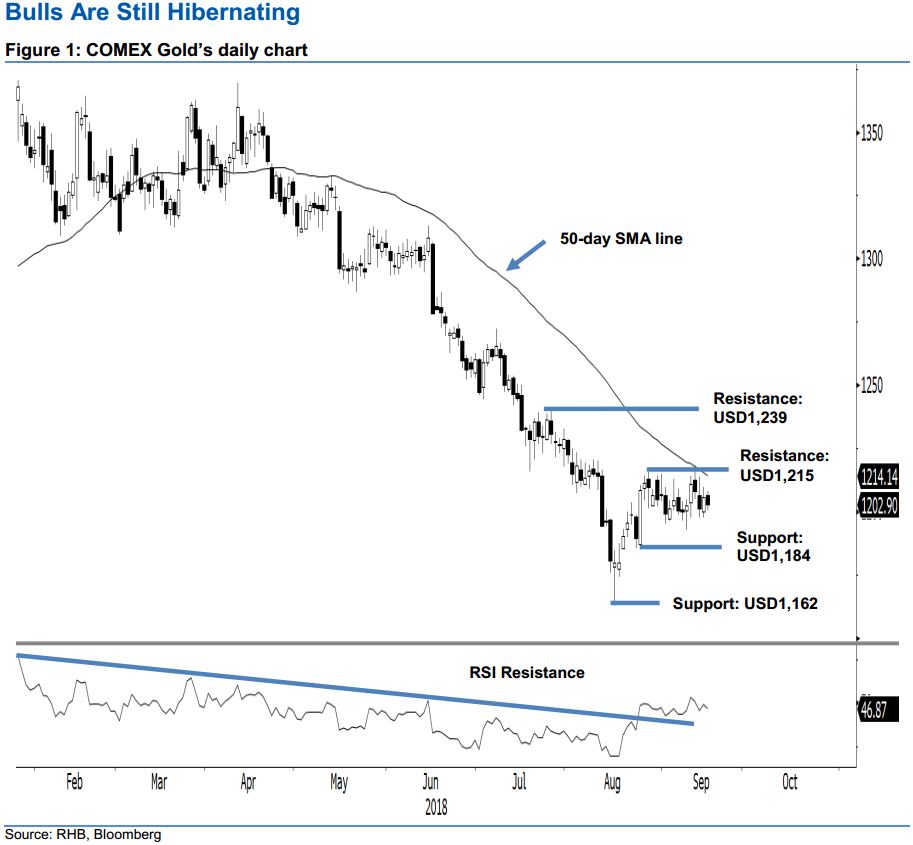

Bias for further rebound still intact; maintain long positions. The latest session witnessed the COMEX Gold ending in negative territory. It shed USD2.90 to close at USD1,202.90, after swinging between the negative and positive zones – the low and high were recorded at US1,200.30 and USD1,208.20. The negative session did not alter the consolidation pattern that has been in development over the latest three weeks at below the 50-day SMA line. This implies chances are high that the commodity may still be able to extend its corrective rebound, which started from the low of USD1,162 on 16 Aug. With this technical interpretation, we maintain our near-term positive trading bias.

As we observe no signs which can suggest for the YTD deep retracement to return, and provided the immediate support of USD1,184 is not breached, we continue to advise traders to keep to long positions on the commodity. We initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For risk management, a stop-loss can be set at below USD1,184.

Immediate support is set at USD1,184, the low of 24 Aug. This is followed by the critical support of USD1,162, registered on 16 Aug – also the YTD low. On the flip side, immediate resistance is at USD1,215, the low of 20 Jul. This is followed by USD1,239, or 26 Jul’s high.

Source: RHB Securities Research - 19 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024