FKLI & FCPO - FKLI: Bulls Remain in Control

rhboskres

Publish date: Wed, 19 Sep 2018, 04:40 PM

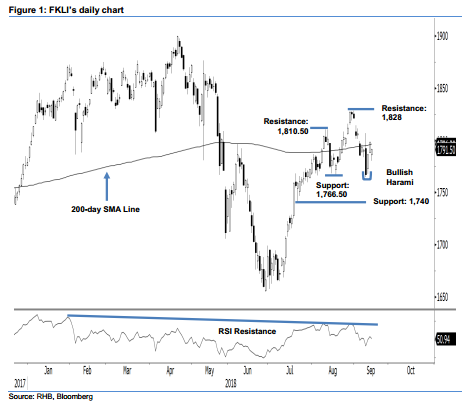

Maintain long positions. The FKLI performed weakly in the latest session - ended at 1,791.5 pts, implying a decline of 6.5 pts. This came after it rebounded from the intraday low of 1,780.5 pts in the early session. The high was posted at 1,792 pts. The closing level means the index is, again, being pushed back below the 200-day SMA line. Despite this, the upward bias remains in place. This bias will continue remain in place if the immediate support of 1,766.5 pts is not invalidated. Hence, we are keeping our near-term positive trading bias.

With the assessment that the index is still showing a constructive technical picture and not showing signs of developing a deeper retracement – we continue to advise traders to maintain their long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

We maintain the immediate support at 1,766.50 pts, ie 31 Jul’s low. Breaking this may see the market test 1,740 pts, the low of 20 Jul. Towards the upside, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 19 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024