Hang Seng Index Futures - Near-Term Outlook Stays Positive

rhboskres

Publish date: Wed, 19 Sep 2018, 04:48 PM

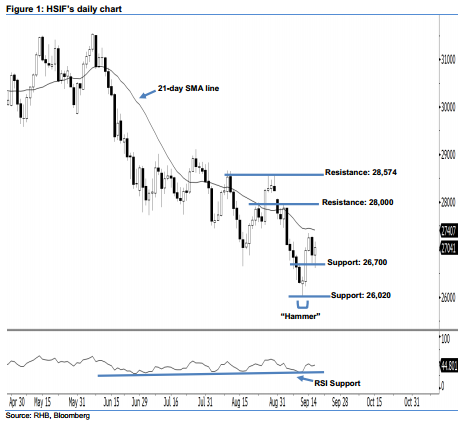

Near-term rebound is not over yet; maintain long positions. The HSIF formed a white candle yesterday. It settled at 27,041 pts, after oscillating between a high of 27,169 pts and low of 26,605 pts. Technically, we maintain our near-term positive view, as the index has marked a higher close vis-à-vis the previous session. Meanwhile, as long as the index does not negate the bullishness of 12 Sep’s “Hammer” pattern, the near-term rebound is still in effect. Overall, we keep our positive view on the HSIF’s near-term outlook.

As seen in the chart, we are eyeing the immediate support at 26,700 pts, situated near the midpoint of 13 Sep’s long white candle. The next support is seen at 26,020 pts, obtained from the low of 12 Sep’s “Hammer” pattern. Towards the upside, we anticipate the near-term resistance at the 28,000-pt psychological mark. This is followed by 28,574 pts, which was the previous high of 30 Aug.

Thus, we advise traders to maintain long positions, following our recommendation to initiate long above the 26,700-pt level on 14 Sep. At the same time, a stop-loss is preferably set below the 26,020-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 19 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024