COMEX Gold - a Stubborn 50-Day SMA Line

rhboskres

Publish date: Thu, 20 Sep 2018, 04:42 PM

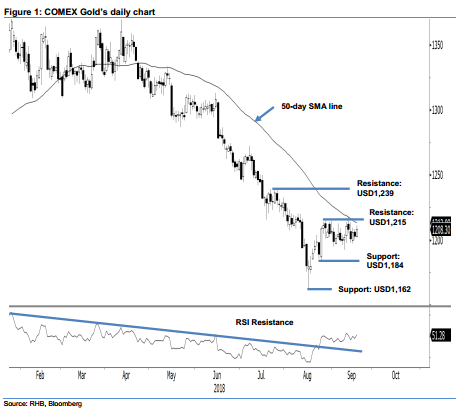

Maintain long positions. The COMEX Gold performed positively in its latest session, forming a white candle and ending USD5.40 higher at US1,208.30. The intraday trend was positive, as it generally scaled higher: the low and high were recorded at USD1,202.20 and USD1,211.00. While the commodity is still capped by both the 50-day SMA line and USD1,215 immediate resistance, we observed that the pattern – which has been in development over the past three weeks – remains constructive. This seems to suggest the commodity is building a base before the next possible upward move. On these technicalities, we maintain our near-term positive trading bias.

As the technical picture remains constructive – and the corrective rebound, which started from the low of USD1,162, has not shown signs of ending – we continue to advise traders to keep long positions on the COMEX Gold. Recall that we initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For riskmanagement purposes, a stop-loss can be set at below the USD1,184 threshold.

We maintain the immediate support at USD1,184, which was the low of 24 Aug. Breaking this may see the market retest the USD1,162 critical support registered on 16 Aug – this was also the YTD low. On the other hand, the immediate resistance is at USD1,215, or the low of 20 Jul. This is followed by the USD1,239 level, ie 26 Jul’s high.

Source: RHB Securities Research - 20 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024