FKLI - Hovering Over the 200-Day SMA

rhboskres

Publish date: Thu, 20 Sep 2018, 04:50 PM

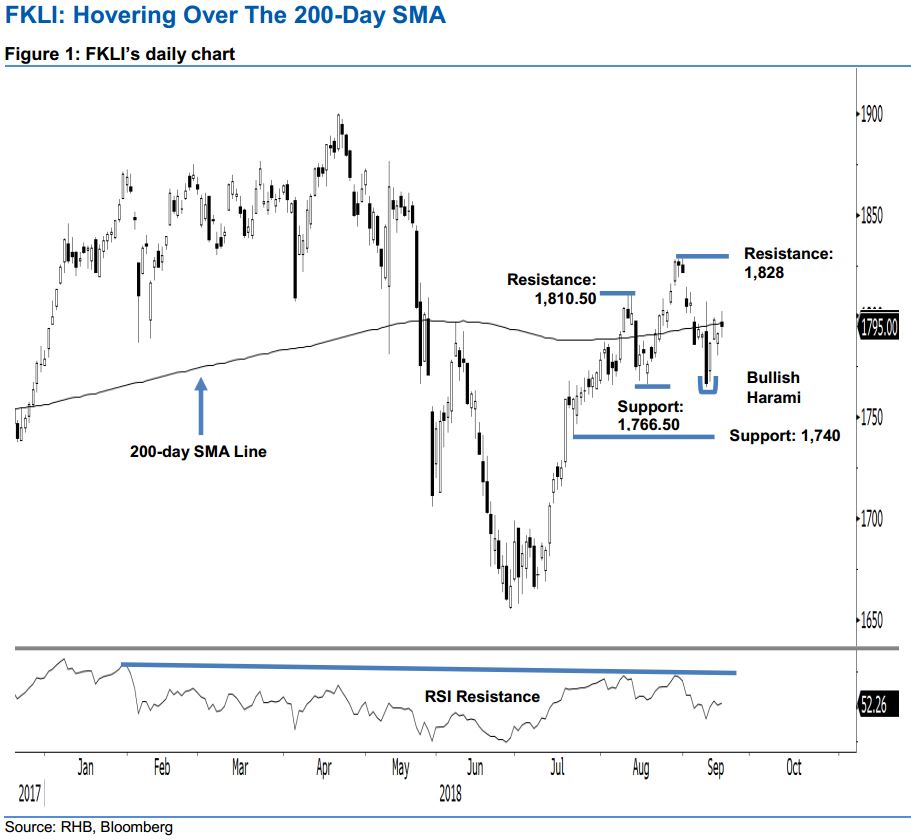

No change to the positive bias; maintain long positions. Yesterday, the FKLI ended slightly higher after moving around the 200-day SMA line (current reading: 1,797 pts). For the intraday, the index trended lower – as it failed to hold above the 1,800-pt level – from a high of 1,802.5 pts to a low of 1,789.5 pts. It closed the session at 1,795 pts, indicating a gain of 3.5 pts. While the index is still struggling to crack above the SMA line, we are not seeing a clear price rejection from the said line either – if this happens, though, it may indicate that a deeper retracement may be developing. The neutral RSI reading of 51 also suggests there is still room for a further extension of the rebound. As such, we are keeping our near-term positive trading bias.

As the risk of a deeper retracement happening will only be signalled by a firm downside breach of the immediate support of 1,766.5 pts (for now), traders should remain in long positions. For risk management purposes, a stoploss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

Towards the downside, the immediate support is at 1,766.50 pts, ie 31 Jul’s low. The second support is at 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 20 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024