FCPO - Bears Are Charging Ahead

rhboskres

Publish date: Thu, 20 Sep 2018, 04:50 PM

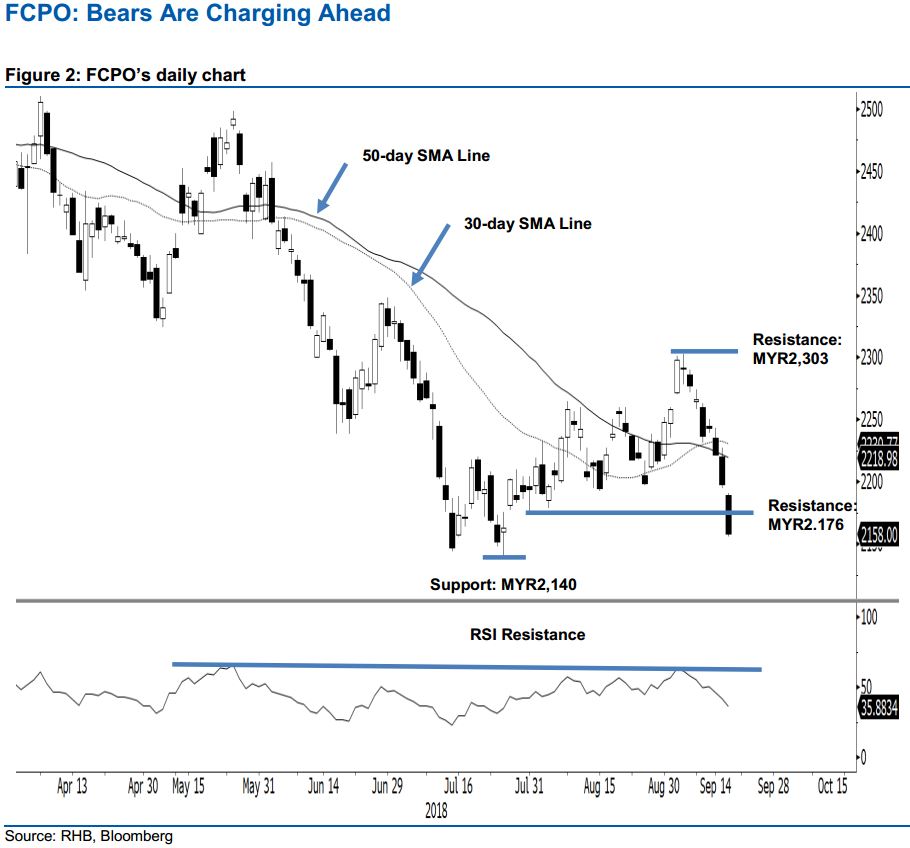

Immediate support dissolved; maintain short positions. Yesterday, the FCPO formed a black candle and, at the closing, invalidated the previous immediate support of MYR2,176. The intraday trend was negative as the commodity moved lower throughout the session. The low and high were recorded at MYR2,156 and MYR2,191, it closed MYR40 lower at MYR2,158.

The breakdowns from the said previous immediate support - as well as both the 30-day and 50-day SMA lines recently, has increased the likelihood of the YTD deep retracement resuming. Hence, we keep to our near-term negative trading bias. The breakdown from the said previous immediate support lends further support to the bears – so we are still recommending that traders remain short. We initiated these positions at MYR2,222, the closing level of 14 Sep. To manage risks, we revise the trailing-stop to the breakeven level.

We revise the immediate support to MYR2,140, the low of 25 Jul. This is followed by MYR2,100, a round figure. Towards the upside, immediate resistance is now pegged at MYR2,176, the low of 31 Jul. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 20 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024