WTI Crude Futures: Bulls Test the Immediate Resistance

rhboskres

Publish date: Thu, 20 Sep 2018, 05:19 PM

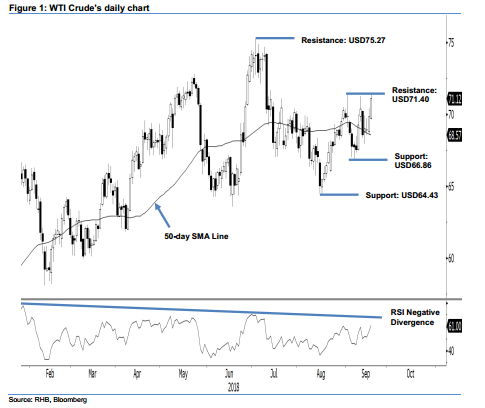

Maintain short positions until the immediate resistance is taken out. The WTI Crude formed a white candle in the latest session and, in the process, tested the USD71.40 immediate resistance. The session’s tone was positive, as the commodity trended higher from a low of USD69.65 to a high of USD71.50 – this was before ceasing the day USD1.27 higher at USD71.12. The positive session can be seen as a follow-up of the rebound from the 50-day SMA line in the prior session. However, as mentioned before, in order for the bulls to take control over the nearterm trend, said immediate resistance needs to be decisively breached. Until that happens, we maintain our nearterm negative trading bias.

As there is still a lack of clear evidence that the recent two sessions’ rebounds may be extended – to be signalled by a firm upside breach of said immediate resistance – we continue to advise traders to keep their short positions. To recap, we initiated these short positions on 12 Jul after the WTI Crude plunged below the USD72.83 level. For risk-management purposes, a stop-loss can be placed above the USD71.40 threshold.

We set our sights at the USD66.86 mark – the low of 7 Sep – as our immediate support. The second support is at USD64.43, or the low of 16 Aug. Moving up, we maintain the immediate resistance at USD71.40, which was the high of 4 Sep. This is followed by USD75.27, ie the high of 3 Jul.

Source: RHB Securities Research - 20 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024