WTI Crude Futures - Immediate Resistance Holding

rhboskres

Publish date: Fri, 21 Sep 2018, 04:51 PM

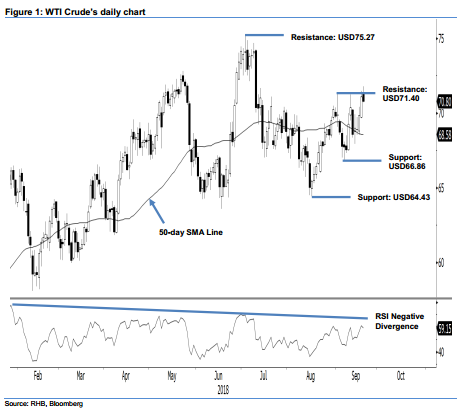

Maintain short positions given the bulls’ failure to break through the immediate resistance. The WTI Crude ended the latest session weaker. At one point during the session, the commodity tested the immediate resistance of USD71.40 with an intraday high of USD71.81, before slipping lower to end at USD70.80 – a decline of USD0.32. The low was at USD70.73. The failure of the commodity to crack above the said immediate resistance – despite three attempts over the past three weeks – signals a price rejection from this level. As mentioned, this level needs to be breached on the upside decisively for the bulls to gain control over the price trend. Until that happens, the bias is for the correction that has been in development since early July to remain in place. Based on this, we maintain our near-term negative trading bias.

As the trend is still in favour for the commodity to extend its correction phase – we continue to advise traders to keep their short positions. To recap, we initiated short positions on 12 Jul after the WTI Crude plunged below the USD72.83 level. For risk management purposes, a stop-loss can be placed above the USD71.40 threshold.

Immediate support is pegged at the USD66.86 mark, which was the low of 7 Sep. This is followed by USD64.43, or the low of 16 Aug. On the other hand, we maintain the immediate resistance at USD71.40, which was the high of 4 Sep. This is followed by USD75.27, ie the high of 3 Jul.

Source: RHB Securities Research - 21 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024