FKLI & FCPO - FKLI: Testing the 200-Day SMA Line

rhboskres

Publish date: Fri, 21 Sep 2018, 04:54 PM

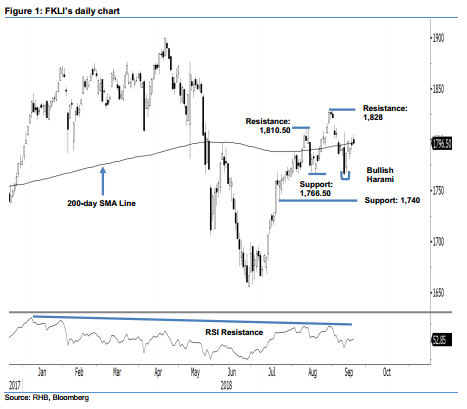

Maintain long positions. The FKLI ended the latest session edging up slightly by 1.5 pts to close at 1,796.5 pts. The index again failed to establish a strong footing above 1,800 pts and the 200-day SMA line (current reading: 1,797 pts). Session’s low and high were posted at 1,795 pts and 1,804.5 pts. Price actions over the past sessions indicate the bulls are still trying to breach the 1,800-pt mark and 200-day SMA line. For now, the risk for a retracement from these levels is relatively low, as we are not seeing any clear signs of a price rejection. If it happens, the immediate support of 1,766.5 pts could potentially be retested. Hence, we are keeping our near-term positive trading bias.

Provided the said immediate support continues to hold, the probability for the index to extend its rebound would still be positive. As such, we continue to suggest traders to remain in long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

The immediate support is stayed at 1,766.50 pts, ie 31 Jul’s low. This is followed by 1,740 pts, the low of 20 Jul. Moving up, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 21 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024