Hang Seng Index Futures - Accelerates Upwards

rhboskres

Publish date: Mon, 24 Sep 2018, 09:53 AM

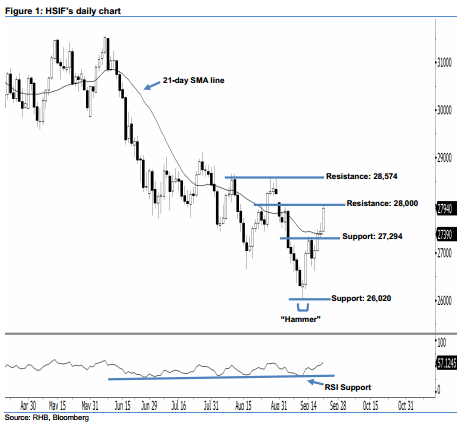

Stay long while setting a new trailing-stop below the 27,294-pt level. The buying momentum in the HSIF continued as expected. A long white candle was formed last Friday, which pointed towards a continuation of the upside move. It surged 481 pts to close at 27,940 pts, off the session’s low of 27,456 pts and high of 27,982 pts. As the index has posted a fourth consecutive white candle, this indicates that the near-term rebound is likely to persist. We view last Friday’s long white candle as a continuation of the bullish reversal pattern of 12 Sep’s “Hammer” pattern. Overall, we keep our positive view on the near-term outlook.

Based on the daily chart, the immediate support level is now seen at 27,294 pts, determined from the low of 20 Sep. The crucial support is anticipated at 26,020 pts, ie the low of 12 Sep’s “Hammer” pattern. On the other hand, we are eyeing the near-term resistance level at the 28,000-pt psychological spot. This is followed by 28,574 pts, obtained from the high of 30 Aug.

Recall that on 14 Sep, we initially recommended traders to initiate long positions above the 26,700-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,294-pt threshold. This is in order to secure part of the gains.

Source: RHB Securities Research - 24 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024