WTI Crude Futures - Bulls Are Still Struggling

rhboskres

Publish date: Mon, 24 Sep 2018, 09:56 AM

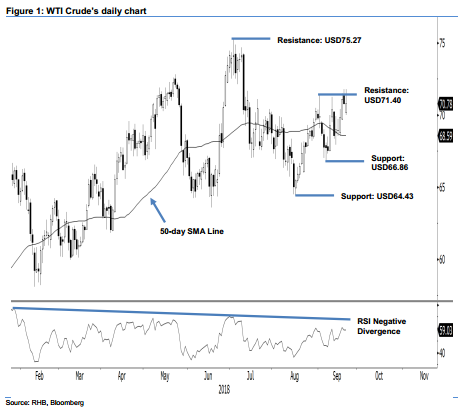

Maintain short positions. The WTI Crude ended Friday’s session on a neutral tone – it softened marginally by USD0.02 to close at USD70.78. This came after the commodity tested the immediate resistance of USD71.40 with a high of USD71.80, while the low was at USD69.98. The inability of the bulls to close the commodity above the said immediate resistance – despite four attempts over the past three weeks – suggests a price rejection at this resistance mark. As mentioned, the overall tone may only change from negative to positive if this level can be taken out decisively. Until that happens, we are keeping our near-term negative trading bias.

With no price signal to suggest a turn in the negative bias in the near-term, we continue to advise traders to keep their short positions. To recap, we initiated short positions on 12 Jul after the WTI Crude plunged below the USD72.83 level. For risk management purposes, a stop-loss can be placed above the USD71.40 threshold.

We maintain the immediate support at the USD66.86 mark, which was the low of 7 Sep. the following support is at USD64.43, or the low of 16 Aug. On the flip side, we maintain the immediate resistance at USD71.40, which was the high of 4 Sep. This is followed by USD75.27, ie the high of 3 Jul.

Source: RHB Securities Research - 24 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024