Hang Seng Index Futures - Near-Term Sentiment Remains Positive

rhboskres

Publish date: Tue, 25 Sep 2018, 09:48 AM

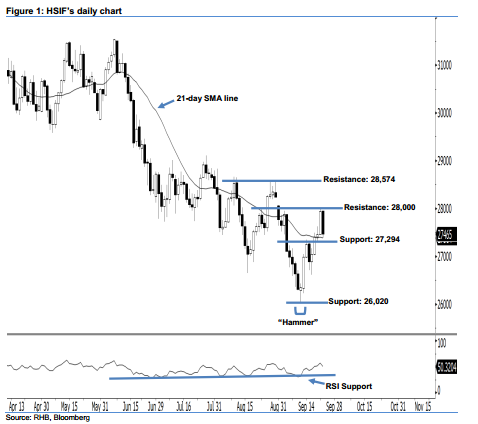

Stay long, with a trailing-stop set below the 27,294-pt support. The HSIF ended lower to form a black candle yesterday. It closed at 27,465 pts, off its high of 27,945 pts and low of 27,388 pts. Despite this, we maintain our near-term positive sentiment, as the index is still trading above the 21-day SMA line. Given that the previouslyindicated 27,294-pt support is not violated at the closing, this shows that the near-term rebound is not diminished yet. Overall, we expect the market to rise further if the immediate 28,000-pt resistance is taken out decisively in the coming sessions.

As seen in the chart, we are eyeing the immediate support level at 27,294 pts, obtained from 20 Sep’s low. If the price breaks down decisively, look to 26,020 pts – which was the low of 12 Sep’s “Hammer” pattern – as the next support. To the upside, we maintain the near-term resistance level at the 28,000-pt psychological mark. This is followed by 28,574 pts, situated at the high of 30 Aug.

Hence, we advise traders to maintain long positions, since we had originally recommended initiating above the 26,700-pt level on 14 Sep. A trailing-stop is advisable to set below the 27,294-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 25 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024